New Registration Status at Foundry Group

We have some entertaining news to share with you today. We have recently registered with the SEC and are now considered Registered Investment Advisors. Did we do this so that we can have cooler business cards? No. Did we do this because our back office was lacking in purpose? Heck no.

We had to, per the SEC rules. And the reason you ask? Well, we can’t tell you that or we could possibly break some other SEC rules. So for now, just accept that your friendly neighborhood venture capital firm is now subject to a lot of new and stimulating paperwork.

Why are we even bothering telling you this? Because it will affect what we can say on the Foundry and personal blogs that we write. We’ll have to be careful with statements that we make about companies we invest in. We’ll also be cautious in what we write about our funds or the industry in general. According to the SEC rules, we can no longer write anything that “promotes” our funds. While we’d argue that we never try to promote our firm, but just write anything that comes to mind and try to have fun doing it, with our new registration status comes new responsibilities.

This will be a learning process for us and our goal is to bring you content that is still 100% transparent. Please be patient with us if there are hiccups along the way, or perhaps even questions that we can’t legally answer in the comment sections anymore.

And as always – thank you all for the support. We love what we do and the community, and our interaction with you through our blogs, is a big reason why. And, don’t worry, there will be a third VC video from us – someday.

Joining The B Team

For a long time I’ve been fascinated by the intersection between entrepreneurship and social change. When I say that I’m not describing social entrepreneurship (a term I really don’t like; it’s not a subset of entrepreneurship, it’s simply “entrepreneurship”) or impact investing, at least not as they’re commonly understood in the current business lexicon. I really mean two things: The first is the application of entrepreneurial principles and startup techniques to solving critical, basic needs problems around the world (many of the companies I’ve worked with as a founding board member at the Unreasoanble Institute fall into this category, as one example). The second is that all businesses, regardless of the product or service they produce, can work to create positive change in their communities, including with their employees, vendors and partners (The Entrepreneurs Foundation of Colorado and more recently Pledge 1% are both great examples of organizations helping companies create positive impact in the communities in which they are building their businesses).

For a long time I’ve been fascinated by the intersection between entrepreneurship and social change. When I say that I’m not describing social entrepreneurship (a term I really don’t like; it’s not a subset of entrepreneurship, it’s simply “entrepreneurship”) or impact investing, at least not as they’re commonly understood in the current business lexicon. I really mean two things: The first is the application of entrepreneurial principles and startup techniques to solving critical, basic needs problems around the world (many of the companies I’ve worked with as a founding board member at the Unreasoanble Institute fall into this category, as one example). The second is that all businesses, regardless of the product or service they produce, can work to create positive change in their communities, including with their employees, vendors and partners (The Entrepreneurs Foundation of Colorado and more recently Pledge 1% are both great examples of organizations helping companies create positive impact in the communities in which they are building their businesses).

More recently I’ve become very interested in the B Corp movement. B Corps are for-profit companies certified by the nonprofit B Lab to meet rigorous standards of social and environmental performance, accountability, and transparency. At the core of the B Corp movement is the idea that all companies share a duty for building responsible businesses. Responsible to their employees, to their customers, to their communities. I strongly believe that businesses that treat their constituents well attract and retain employees better, innovate faster, grow more quickly and create more value. I also believe that responsibility for creating a better world is something that can happen at all businesses – not as a side project or something that happens after your “core” work is done, but rather in the actions your business takes every day. By integrating responsible practices throughout an organization, companies can build better businesses while at the same time being agents for positive change in their communities and beyond.

This sort of thinking has been a part of Foundry Group since Jason, Ryan, Brad and I started the fund. In fact, before there was Foundry we got together to talk about our core operating principles. Things such as our “no assholes” rule, what we (along with our friends at Techstars) now call #givefirst, putting entrepreneurs first and including all of our employees (and Pledge 1%) in our carried interest all came out of these discussions. As we’ve operated our firm over the past 9 years we’ve expanded on these ideas and tried to further integrate them into our business and our lives.

It is with great pride that we announce that Foundry Group has achieved B Corporation Certification through B lab. We believe that with this action we’re codifying our long-held beliefs as well as setting an example for others in our ecosystems – fellow venture firms, startups and service providers – to consider doing the same. It’s great to talk about these principles. Becoming B-Certified is our way of showing that we’re truly happy living these principles.

We are also excited that two fellow Colorado venture firms – Colorado Impact Fund and Greenmont Capital Partners – are announcing their B-certifications alongside us. We will join 75 other B-Certified companies in Colorado and over 1,700 in nearly 50 countries around the world including well-known leaders New Belgium Brewing, Patagonia, Seventh Generation, Ben & Jerry’s, Kickstarter, Etsy, Warby Parker and Hootsuite. We also join notable tech B Corps in Colorado such as Rally Software (the first ever B-Corp to go public with that certification), Namaste Solar, Simple Energy, and dojo4.

At Foundry we believe that a group of people acting together towards a common goal can have a far greater impact than when they act alone. With this in mind we challenge everyone reading this to consider joining us in the B Corp movement. #BtheChange

Venture Returns by Sector

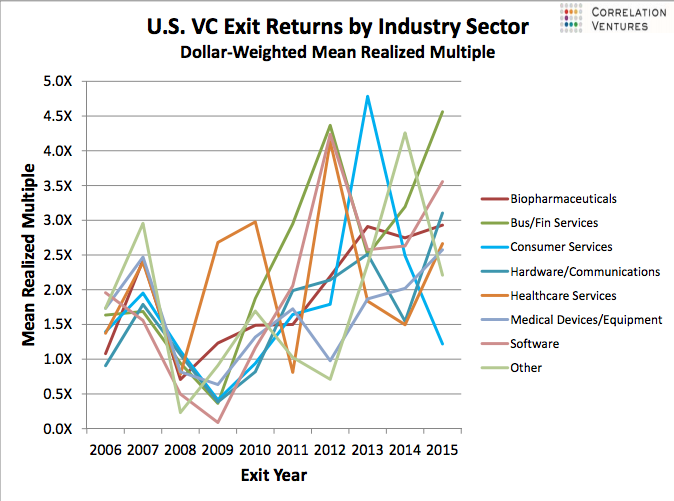

Readers of this blog know that I love sharing data from Correlation Ventures (they have a pretty extensive database of venture deals and venture outcomes and love to post share trends from time to time) – see two great examples using their data here and here from this blog.

A few weeks ago they sent around the chart below which I thought was interesting to share. I’m not surprised at the non-pattern here – as an industry venture is very stochastic. Venture returns are all over the map, really underscoring the need to time diversify venture investing and venture exiting, to the extent to which the latter can be controlled (this graph doesn’t show the date of initial investment, which would be a great new cut at the data – I’ve asked Correlation if they could re-run the analysis that way and will post it if I can get it). Also interesting to note the blip of “Consumer” in 2013 as well as what appears to be a bit of a countercyclical trend in healthcare. Sometimes there are interesting tidbits to be taken from seemingly chaotic data.

Friday Afternoon Inspiration

Short post today from a portfolio company of ours and how they describe their culture and mission. I love it and thought it was a good way to end the week.

The Community Foundation, EFCO and Pledge 1%

Cross posting this article I wrote for The Community Foundation of Colorado. As many of my readers know, I’ve been passionate about the intersection of startups and community for years. And specifically developing a worldwide movement of startups giving back to their local communities from their very founding.

I blog a lot about community: entrepreneurial, local, national, international, social, etc. The short takeaway is that a group of people acting together towards a common goal can have a far greater impact than they expect – and certainly more than they would acting alone. I often use a great scene in the movie Office Space to illustrate this point.

An outgrowth of The Community Foundation’s EFCO initiative – Entrepreneurs Foundation of Colorado – Pledge 1% is a movement that’s caught fire among community-minded entrepreneurs around the world, helping startups set aside 1% of equity, 1% of employee time to volunteerism, and 1% of product to benefit their local communities. We’ve seen immense success in our Colorado community that can be traced directly back to EFCO and Pledge 1%…and now we’re seeing the movement spread around the globe through the Pledge 1% initiative.If you think about any great startup, they tend to share certain common traits. In particular, once they figure out the formula for success, it’s natural to want to scale that as far and as wide as possible. We’re doing that with Pledge 1%. After a fantastic startup year where we were housed within The Community Foundation, it’s time to spin off Pledge 1% so it can truly scale globally. To accomplish this, we’ve chosen Tides to house the organization and to ensure its continued global growth – even as EFCO continues to operate under the umbrella of The Community Foundation, working as the entry point for Colorado companies inspired to join the movement.

EFCO is tightly connected to The Community Foundation, and I’ve seen firsthand the foundation’s crucial role in providing the foresight, expertise and resources needed to test the premise and scalability of the EFCO model. I’m both impressed and thankful that the foundation recognized the broader potential of EFCO, and galvanized around it alongside some big players – including the Salesforce Foundation, Atlassian, and Rally for Impact.

The Community Foundation provides the kind of nurturing that’s needed to launch and grow innovative ideas – in this case, EFCO’s paving the way for startup companies to give back to their communities has ignited action worldwide. For entrepreneurs passionate about giving back to the communities in which they build their businesses, the potential is endless.

Case in point: via EFCO, the Foundry Group made a gift of $300,000 to Boulder County nonprofits last summer in response to a 62% funding cut from Foothills United Way. This is just one of a number of gifts that Foundry has channeled through the EFCO program. And this is the kind of impact that drives EFCO members: filling the gaps affecting local nonprofits, helping individuals and families who are struggling to make ends meet, and strengthening the very communities that have contributed to our own success. All told, since its founding eight years ago, EFCO – more than 100 members strong – has generated more than $4M for local nonprofits.

It starts with being community-minded, and The Community Foundation has long fostered the notion of giving locally. The success of EFCO and rapid spread of Pledge 1% bear witness to the fact that we can accomplish more together than we do alone – right here at home, and in “local” communities around the world. I invite you to learn more at www.efcolorado.org and www.pledge1percent.org. Join the movement and make an impact!

The Importance of Robust Angel Ecosystems

Earlier this week I gave the keynote address at the Colorado Angel Capital Summit. While the audience was Colorado focused, the overall message I delivered about the angel ecosystem is very relevant to all entrepreneurial communities. I thought I’d share both the presentation and the key thoughts here.

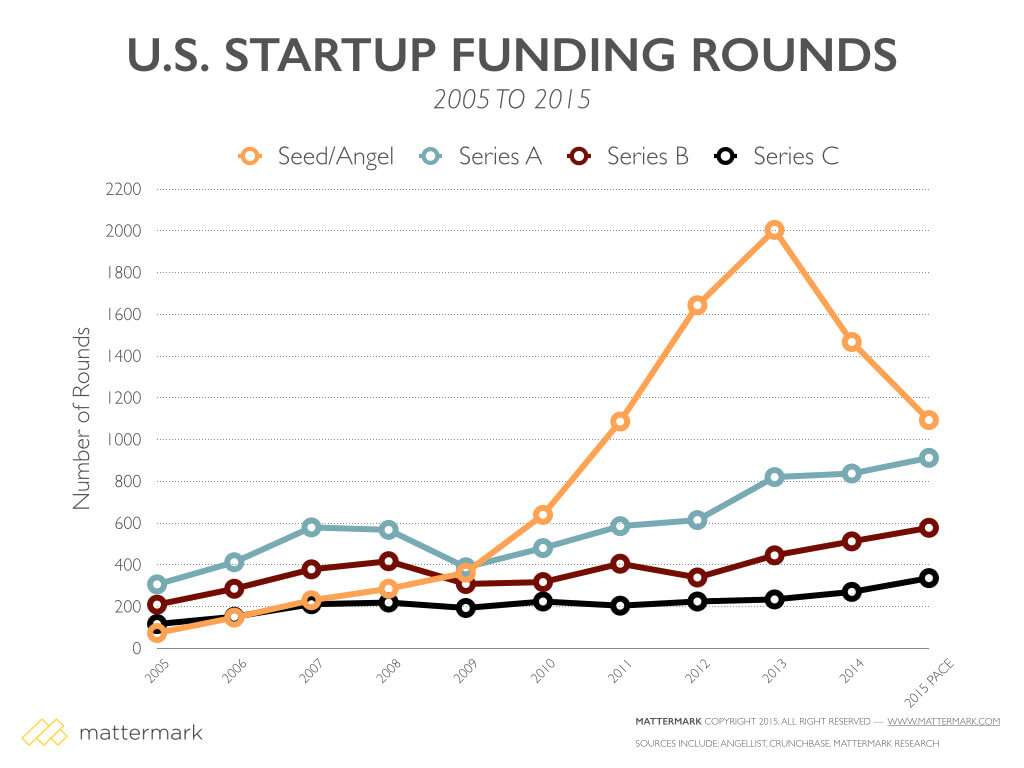

The overall trend around angel investing is a pretty interesting one. I’ve talked about this trend before – specifically the acceleration of angel investing in 2011-2014. I think what we’re really seeing here is market excitement around angel investing leading to a quick surge, followed by (I hope) a more normal and sustained level of activity. The sharp rise in angel activity also coincided with the raise of platforms such as AngelList which more easily allowed investors to find interesting companies and to some extent broadened the geographic reach of angels, extending what had been a more localized activity. If you’ve ever participated in a running or cycling race your heart rate graph probably looked similar – you’re excited at the start of the race and go out a bit strong, only to settle back into the right rhythm. I suspect that’s a bit of what we’re seeing here.

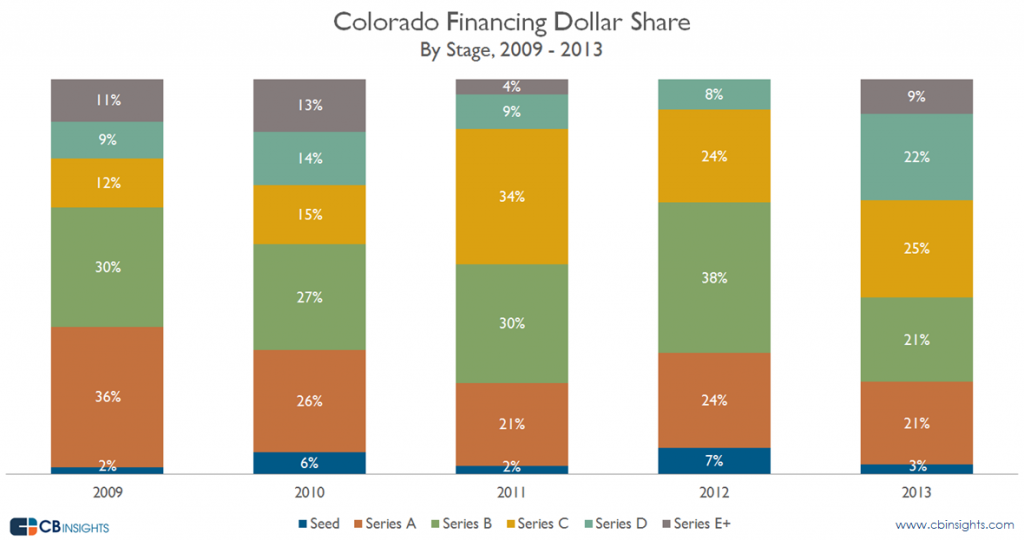

I’ve always felt that a robust angel financing market was important to startup ecosystems and the data on the next two charts really brings that home. These data are specific to Colorado (since my presentation was to a CO audience) but the trend holds true across startup ecosystems. Looking at the dollar share of investing, not surprisingly investing at the Angel/Seed level barely registers, with well less than 10% share (under 5% in a few years).

I’ve always felt that a robust angel financing market was important to startup ecosystems and the data on the next two charts really brings that home. These data are specific to Colorado (since my presentation was to a CO audience) but the trend holds true across startup ecosystems. Looking at the dollar share of investing, not surprisingly investing at the Angel/Seed level barely registers, with well less than 10% share (under 5% in a few years).

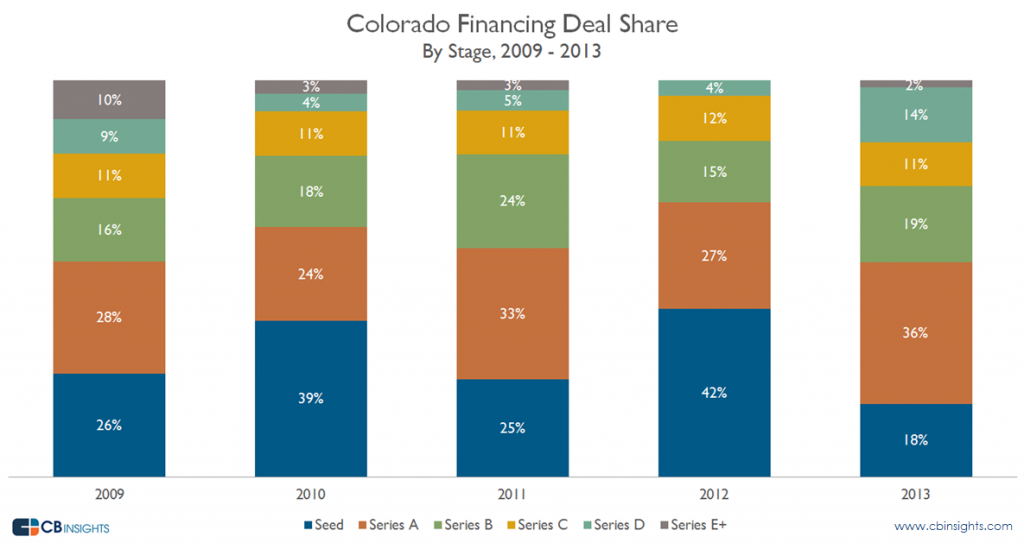

But looking at Seed investing on a deal share basis shows just how impactful this money is to a startup ecosystem – a significant number of companies in any given year raise capital from Angel/Seed investors. Clearly access to capital at this stage has been, and continues to be, critical to the success of the Colorado (and national) startup ecosystem.

While there’s a lot of seed stage investing going on in Colorado and other markets, there are some clear challenges to how many angel investors are approaching the market. I hit these hard in my talk and I’m going to reinforce them here. Angel investors need to do a better job aligning their outcomes with that of the companies in which they invest and the ecosystems they support. Many are approaching the market in ways that are antithetical to successful startup investing. Specifically:

Put Entrepreneurs First. We talk about this a lot at Foundry because it’s the core of our investment philosophy. It’s reflected in how we treat entrepreneurs, how we work with our portfolio companies and the kind of structures we use for our investments. Too many angels don’t embody this and it creates misalignment between them, the companies in which they invest, and between them and later round investors. Even at the angel level terms should be clean, fair and align with management (preference multiples, “$50k for half your company”, etc are neither clean nor fair – to use specific examples that I’ve seen in the market).

Angels are often unorganized and have scattered and burdensome investment processes. Most angel deals happen in syndicates (meaning multiple investors participate), yet many angels are extremely poor at working together with other potential investors. The results are burdensome on a company, result in the duplication and overlap of due diligence and force too much of the syndication work on the company itself. Good angel investors develop a thesis around an investment, bring in the appropriate resources to reach an investment decision, are secure in that opinion without the need for other investors to validate their belief and then work with a company to bring a deal together rather than sit on the sidelines and see what happens. Too many angel investors waste company time, wait for others to validate their decisions and aren’t helpful in getting a round to come together even after they’ve nominally decided to invest.

Successful angel investing requires diversification. I (somewhat) jokingly said during my talk that angel investors should pick an amount of money that they’re willing to light on fire, then divide by at least 10 (better yet 20) to figure out how much they should invest in any given deal. While I know there are some that like to concentrate their bets, the history of angel investing suggests otherwise – there’s such a high mortality rate among early stage companies that a successful angel portfolio needs some level of diversification (baring that, you’re just playing the lottery and hoping to get lucky).

Successful angel ecosystems have active angel mentor networks. With the explosion of accelerators most startup communities around the country and the world are developing very robust mentor networks for companies. Very few of these markets have any even remotely similar at the investor level. That’s a problem, as the same kind of mentoring that takes place between seasoned executives and startups needs to also take place between successful angel investors and new investors. In my view, angel investors are not at all competitive with one another in a market (although many wrongly believe that they are competing for the “best” deals) – they can only make their own investment portfolios stronger by strengthening the overall angel ecosystem in their market.

There’s quite a bit more from the presentation but these are some of the important ideas that I wanted to highlight. The full presentation is embedded below for you to click through if you’re interested. There’s also some interesting data that we haven’t published yet on the 66 companies that ended up being a part of our AngelList Syndicate. I’ll pull those out in a separate post, but if you’d like a preview you’ll find that on pages 11 – 17 below.

The Power of We

This is not a post about politics, but let me start with something I’ve noticed over the past few weeks in the presidential race, which is Hillary Clinton’s shift from using “I” to using “We” in her speaches. Bernie Sanders has been using plural language for pretty much the entirety of his campaign and it’s been an effective tool for him to make audiences feel that they’re in this with him. On the republican side, Ted Cruz uses this language very effectively (interesting Trump seems to vacillate – sometimes in the same sentence – between the use of I and We).

This is not a post about politics, but let me start with something I’ve noticed over the past few weeks in the presidential race, which is Hillary Clinton’s shift from using “I” to using “We” in her speaches. Bernie Sanders has been using plural language for pretty much the entirety of his campaign and it’s been an effective tool for him to make audiences feel that they’re in this with him. On the republican side, Ted Cruz uses this language very effectively (interesting Trump seems to vacillate – sometimes in the same sentence – between the use of I and We).

It’s a small shift in language but it has a powerful effect – at the same time enrolling the audience and making the speaker seem more humble.

Years ago at Foundry we realized that we were often using I instead of We when talking about our firm, our investments and our thoughts on the market. It was subtle but working against what we were trying to build as a firm and also sending the (wrong) message that whomever was speaking at the time was somehow separate (perhaps perceived as above) the partnership. It took us a while to notice this but eventually we did and it precipitated a great conversation at one of our quarterly offsites. We immediately changed our language and to this day talk about the shift from I to We and how powerful it has been for us.

Worth checking your own use of pronouns to see how you’re describing your projects, your team and your company.

Entrepreneurial Density

I’ve been throwing this term around for a while and thought it was worth writing about, as I believe that understanding entrepreneurial how density can shape an entrepreneurial ecosystem is very important.

I’ve been throwing this term around for a while and thought it was worth writing about, as I believe that understanding entrepreneurial how density can shape an entrepreneurial ecosystem is very important.

But first, a link back to some ideas around entrepreneurial communities in general. My partner Brad literally wrote the book about this (highly recommended if you haven’t read it already). But the very quick summary is that great entrepreneurial communities are build on the basis of a few key tenets (Brad writes about these in much more detail in the book, which – again – you should read)

– Startup Communities Take Time. Think 20 years. And they don’t happen overnight (despite what you may have heard about Boulder – it took plenty of time to develop here too).

– Startup Communities Are Led by Entrepreneurs. For some reason I still can’t figure out, many VCs get this backwards. But great entrepreneurial communities are led by entrepreneurs.

– Startup Communities Have Many Leaders And Are Not Hirearchical. Related to being led by entrepreneurs, great entrepreneurial ecosystems have many leaders. They don’t need to be working in a coordinated fashion (but see the next point on being inclusive) but they do need to be working for the greater good of the community. Additionally these communities are meshed in their network structure vs being hub and spoke or centralized. There’s no hierarchy in strong entrepnreurial communities.

– Startup Communities Are Open. It’s pretty critical in any startup community to be open and welcoming. People come to entrepreneurship from lots of different background and bring different perspectives. They’re also working across the stack of petential problems and forming companies that are varied in their make-up, focus and goals.

It’s funny. I thought for sure I had written about this before, but when I looked it turned out I hadn’t. Brad has some great content up (in addition to his book, which I’ve now mentioned 3 times that you really should read). There are a few videos up (see here and here) where I touch on these topics if you’re interested in digging deeper (they’re long but it’s a meaty topic…). Felt like it was worth prefacing the rest of this post with these thoughts on Entrepnreurial Ecosystems and Startup Communities First.

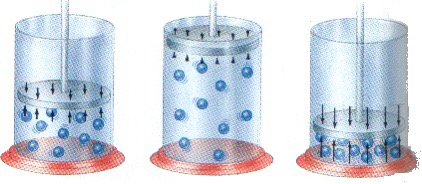

So how does Entrepreneurial Density have to do with this? I’m starting to develop a thesis around the ways in which Entrepreneurial Communities follow something pretty akin to Boyles Law. For those of you that have forgotten high school chemistry, Boyles Law describes the behavior of gasses – it describes how the pressure of gas increases as the volume decreases.

Startup Commnunities can behave in a very similar fashion. The smaller the physical space in which entrepreneurial activities are taking place, the faster those activities happen, the more serendipity emerges and the more that community thrives. This often happens somewhat naturally – startups like to be around other startups for example. But they can also be encouraged to happen – co-working spaces are good examples of systems trying to create density; sometimes enterprise zones can create this effect, often a group in a particular city gets together and consciously tries to create an area of town that’s particularly attractive to startups. I lived this in Boulder without really realizing at the time what was going on. In 2007 Foundry moved from an office park on the highway to the west side of town. There were already a number of startups there (our office formerly belonged to Rally Software, Lijit Networks was upstairs, many more companies were nearby). We moved there because we liked the location and it was near to where 2 of the Foundry partners lived. Over time more and more companies moved to that side of town and we built a little bit of a community within a community where people were constantly bumping into each other on the street, getting coffee, at lunch, etc. In our building alone we’ve had about a dozen portfolio companies have an office at one time or another.

To be clear, it’s not that density is required to build a great entrepreneurial ecosystem (and I feel passionately about the virtual community that’s connecting entrepnreurs around the work – perhaps with this new lens, creating virtual density as well). But community building is about creating the environment that allows for the entire system to thrive and creating density in a community is an important way to help speed up that process.

An important credit to end this post. I first starting thinking about density a number of years ago when Brad Burnham mentioned it to me. I doubt he remembers that specific conversation but, like many conversations I’ve had with Brad over the years, it was an impactful one.

What the current markets are and are not telling us

In response to a comment to my post earlier this week about the Profit Imperative, I rattled off some ideas about the current state of the markets. I thought it was worth sharing as a full post (I’ve edited and expanded on the original comment).

There are clearly headwinds in the markets – I’m not at all suggesting that there aren’t. And we may be in a period of strong negative pricing pressure in both the public and private markets. As you know, markets tend to perpetuate themselves and pendulum. This cycle of overreacting is how business and market cycles seem to work. Without a doubt we’re in an environment of increasing volatility and that volatility alone may spook some investors. Price shifts at the top of the market, starting with the public markets and quickly spreading to the public market investors who had been dipping into the late stage private markets and continuing from there, will and are clearly changing pricing across all stages of private market financings.

I’m generally of the view that we’re not in a bubble (see my post on that from last September here). While there’s no functional definition of an asset “bubble” that people seem to agree on, let’s at least agree that they’re caused by a fundamental imbalance between the actual “value” of an asset and the way the markets are pricing that asset. We saw this clearly in the housing market when the access to cheap capital created run-away housing prices that weren’t sustainable by any historical measure of actual underlying value. We’ve certainly seen this in the public and private markets as well (for example in the 2000 crash where truly unsustainable levels of funding were driving too many bad ideas into the market and the perception of market value and future growth and profit potential was completely out of balance with reality).

I’d differentiate this from what we saw in 2008 in the private markets where prices contracted – in some cases relatively dramatically – but where there wasn’t a true bubble bursting in the way we saw in 2001. The private markets in that case were reacting to the larger trends in the public markets (the US consumer was in a painful process of shedding debt and readjusting their balance sheets after the housing bubble broke) and to a supply and demand change in the availability of capital. That so many great companies were started in this period perhaps suggests that the venture capital markets over reacted to what was taking place in the public markets (and that’s just one measure of the over-reaction).

When I look at the fundamental value of public comps, we’re already well below historical averages (and weren’t even at the top of those averages when the markets started correcting). When I see the drastic proclamations of arageddon I think they’re unjustified by the current actual market conditions. When I look at the US economic data I don’t see anything justifying the wide sell-off in the market. When I see companies announce 1-time tax hits and drop 40% of their value overnight, I see a market that’s overreacting.

There is clearly plenty of negative sentiment in the marketplace and this sentiment tends to be self fulfilling – we will see a contraction at Series A and (especially in my mind) at Series B. Capital will retreat, companies will have a harder time raising money and pricing will adjust (however to be clear, the rise of seed rounds in the past year is nothing like the overfunding of Series A and B that we saw in 99′ – and some might argue is good for the overall ecosystem as more ideas get enough legs to test whether they have merit and those that do go on to raise their A rounds). This is a bit of an oversimplification but to some extent we live in a bifurcated world. There’s a big difference in market behavior at the high end of the markets where there has been a “bubble” around so called unicorn companies who were chasing that billion dollar valuation. This led to aggressive valuations, to aggressive terms and to aggressive expectations on growth that I think are about to come home to roost in that market segment. But to be clear, I thought this long ago and well before the public markets started reacting.

Which all leads me back to my most important business mantra:

1) don’t panic

2) gather information

3) make informed decisions

As always, the order here matters a lot.

Welcome to Foundry

I send a note to each new company that I work with at Foundry that sets up what I hope will be the key tenants of our working relationship. I thought it might be fun to post it publicly – I think it gives meaningful insight into how all of us at Foundry work with the company in which we have an investment.

I send a note to each new company that I work with at Foundry that sets up what I hope will be the key tenants of our working relationship. I thought it might be fun to post it publicly – I think it gives meaningful insight into how all of us at Foundry work with the company in which we have an investment.