Ello World

At the front end of every new investment we hope we’ve found the next break-out company. But it’s rare when you have the feeling that you’re investing in a business that may both be that and has the potential to touch millions of lives. We feel we’ve found that in Ello – a social networking business that’s part Twitter, Tumblr, and Facebook, but at the same time all its own. Ello is a beautiful and easy to use product that allows people to express themselves as they see fit but without relying on selling its users to make money. We’ve just led the Series A financing for the business along with Bullet Time Ventures and FreshTracks Capital. As part of the financing, I’ll be joining the Ello board. You can find the Foundry post about this investment here, and a post from Mark Solon of Bullet Time Ventures here.

At the front end of every new investment we hope we’ve found the next break-out company. But it’s rare when you have the feeling that you’re investing in a business that may both be that and has the potential to touch millions of lives. We feel we’ve found that in Ello – a social networking business that’s part Twitter, Tumblr, and Facebook, but at the same time all its own. Ello is a beautiful and easy to use product that allows people to express themselves as they see fit but without relying on selling its users to make money. We’ve just led the Series A financing for the business along with Bullet Time Ventures and FreshTracks Capital. As part of the financing, I’ll be joining the Ello board. You can find the Foundry post about this investment here, and a post from Mark Solon of Bullet Time Ventures here.

Before I go any further in talking about my thoughts on this investment it’s important for me to state unequivocally my support (and Foundry’s support) for Ello’s manifesto to build a company that doesn’t rely on advertising or the selling of user data. We’ll either figure out a sustainable business model that doesn’t rely on compromising these values or we won’t have a business. Below is the mission statement that I’ve signed – along the Ello founders and all other investors – making our intentions around this completely clear (you can click on the image below to see a larger version).

Along with the financing we’ve also reincorporated Ello as a PBC (public benefit corporation). PBC is a relatively new concept and this is Foundry’s first PBC investment. The idea is reasonably simple – being a PBC allows us to write into our Charter (the founding document of our business from a legal perspective) that we exist to serve not just our shareholders, but also to uphold specific values. In this case we’ve included in our charter a prohibition for selling advertising and user data. While the charter is an agreement among and between the shareholders of Ello, we took the unusual step of essentially restating our mission in our charter because we wanted to emphasize our commitment to building a business on these terms.

Along with the financing we’ve also reincorporated Ello as a PBC (public benefit corporation). PBC is a relatively new concept and this is Foundry’s first PBC investment. The idea is reasonably simple – being a PBC allows us to write into our Charter (the founding document of our business from a legal perspective) that we exist to serve not just our shareholders, but also to uphold specific values. In this case we’ve included in our charter a prohibition for selling advertising and user data. While the charter is an agreement among and between the shareholders of Ello, we took the unusual step of essentially restating our mission in our charter because we wanted to emphasize our commitment to building a business on these terms.

I suppose it’s easy to be skeptical about these claims – or for that matter, the fact that Ello has investors in the first place. And perhaps nothing I say here will allay the concerns of those who are looking to take shots at something that is gaining momentum and excitement in popular culture (and it might even be a mistake to try to defend Ello and our involvement with it from those that would prefer the company fail). I know plenty about selling advertising on the internet – we have many portfolio companies that help publishers do this (or that are publishers themselves and who make money selling ads). I’m on the board of several of them (you can see the full Foundry portfolio here). And I’m sure those that want to view this financing negatively will point to these companies as evidence that Ello has somehow sold out or they’re bound to change their business model and lose their way in the pursuit of cash.

Simply put: this isn’t the case.

To be clear, Ello is a for profit business. They plan to make money to support the costs of developing and growing the business. They raised this round to support those efforts. I’m confident the team will develop a profitable business model that supports our investment. This wasn’t a charitable investment by Foundry; our mandate is to make money for our investors and we believe that our investment in Ello will help us do that.

One of the things I’m most excited about Ello is Paul Budnitz, Ello’s co-founder and CEO (and the founder of Budnitz Bicycles and before that Kidrobot). I’ve known Paul for 7 years, and over on the Foundry blog talk a little about how we first met Paul, and the singular position he holds in the history of Foundry. I love Paul’s passion and his creative instincts as well as his singular pursuit of his ideas. Creative Genius is a term that’s thrown around much too loosely in our industry, but Paul truly is. He has a visceral passion for Ello and is unstoppable in his quest to create a place for people to interact with their friends that puts users first. It would be easy to dismiss Ello – a new and of late extremely popular social network – as either a flash in the pan or as too idealistic in their mission to stay true to it. But from our perspective Ello is on the cusp of something huge and potentially game changing. And our belief is that they’ll be successful because of their mission, not in spite of it.

You can find me on Ello at @sether.

Ryan Martens on Councilperson Macon Cowles’ Ignorance of the Boulder Startup Community

Like many here in Boulder, I felt that Boulder City Councilperson Macon Cowles’ recent remarks about our startup community were both ignorant and offensive. A group of entrepreneurs posted an OpEd this weekend responding to those remarks in the Daily Camera (it’s worth nothing the diversity of those entrepreneurs vs. Councilperson Cowles’ flatly incorrect characterization of Boulder entrepreneurs). Ryan Martens – a long time Boulder entrepreneur and community activist – felt the same way and asked to borrow this spot to post some of his own thoughts on the diversity of the Boulder entrepreneurial ecosystem as well as the many ways that entrepreneurs in Boulder are giving back to our community. His post follows.

I was very discouraged to see councilperson Macon Cowles’ comments from Boulder’s city council meeting the 2nd week of August. “Boulder’s startup economy brought a lot of very highly paid white men to the city, and they were pricing out families and others.” He then followed up with the statement “I don’t think that’s what people want.” His over simplified view that Boulder’s entrepreneurial community is the direct source of an affordable housing shortage is grossly incorrect.

Why attack the startup community? It is even more disappointing given the significant impact a collaboration between the City of Boulder and local startups could have in addressing complex social issues that face our whole community.

I’d counter his comment with facts: The startup community is very present in positive ways in many aspects of Boulder.

During last year’sflood, startups pulled together to fund relief and contributed more than $200,000 and hundreds of volunteer hours during normal work hours. Most participating startups weren’t even making a profit at the time.

The Entrepreneurs Foundation at the Boulder Community Foundation has contributed more than $2 Million for local non-profits during the past two years through donations of stock options at the time of initial offerings (a circumstance unique to startups).

I want to see our community working and collaborating at a level where we are increasing the economy while addressing issues around environmental sustainability and social equity. It is actually the social mission of my company, (a business I started in Boulder 11 years ago and now employees 250+ in Colorado) – to create Citizen Engineers who use their skills to do just that. The lack of affordable housing issue has been brewing here just like it has in many strong economic cities in America. It is complex issue tied to the income gap, a booming economy and smart growth strategies that started in Boulder the 1950’s with the blue line and the greenbelt. (Don’t get me wrong, I am a huge supporter of these land management solutions and benefitted greatly by learning from the architects of these models while I attended CU in the 1980’s – Thank you Al Bartlett!).

Thanks to the growing activism of the Boulder Chamber of Commerce, programs such as Better Boulder are forming to help address the housing problem with a systemic approach. I would encourage the City to reach out, to collaborate and be open to talented people who care about this community working towards creative solutions.

New programs such as Code for America Fellowship program is one such opportunity to reach out towards a creative solution. This program places two or three full-time technologists on staff with a city government for a year specifically to engage the local citizenry to build a Brigade. The Brigade goes on to develop solutions for municipal efforts. Denver has benefitted from Code for America fellows and the City has applied again for fellows for 2015. Boulder’s startup community and my company support these efforts to wrestle with systemic issues such as affordable housing, while increasing citizen engagement in government through civic hacking.

I know the startup community well through work with the Entrepreneurs Foundation, Startup Colorado and other regional efforts, I have helped actively build community capacity along the Front Range and created a venue for corporate giving to Boulder’s Community Foundation.

Starting a contentious dialog by blaming a single component of our community isn’t constructive and doesn’t inspire solutions. Let’s not take steps backward as a community in our level of engagement. I know the startup community is here to work hard to make it better for all.

Please remember that community is not something we create, but something we need to recognize we are already in, that takes nurturing.

Ryan Martens

CU Grad, 1988 & 1991

Founder, Rally Software

CEO, Entrepreneurs Foundation of Colorado

Board Member, Startup Colorado

Prior-Board member Colorado Conservation Trust, Friends School and Knight Foundation

Accelerating Accelerators

I spent the day on Thursday last week in a small classroom on the Georgetown campus reviewing finalists in the SBA’s Accelerator Competition. Announced a few months ago, the Accelerator Competition is a program of the Small Business Administration through which they are awarding $50k to each of 50 accelerators across the country to promote entrepreneurship (that’s $2.5M in total for those of you w/o a calculator handy). For a government program it has surprisingly few strings attached – it’s really an experiment by the SBA to see if they can facilitate entrepreneurship across the country through providing assistance to the various programs that support entrepreneurs around the country. Of several hundred applicants the group last week reviewed the top 99 to come up with the final 50 who will be awarded the prize.

I spent the day on Thursday last week in a small classroom on the Georgetown campus reviewing finalists in the SBA’s Accelerator Competition. Announced a few months ago, the Accelerator Competition is a program of the Small Business Administration through which they are awarding $50k to each of 50 accelerators across the country to promote entrepreneurship (that’s $2.5M in total for those of you w/o a calculator handy). For a government program it has surprisingly few strings attached – it’s really an experiment by the SBA to see if they can facilitate entrepreneurship across the country through providing assistance to the various programs that support entrepreneurs around the country. Of several hundred applicants the group last week reviewed the top 99 to come up with the final 50 who will be awarded the prize.

I’ve written before about what I’ve been calling the Democratization of Entrepreneurship and why I think it’s so important to think broadly about entrepreneurship. What really struck me about the applicants we reviewed was exactly this. Entrepreneurship is alive and well in the US and it’s thriving in places well outside of what those of us in the tech world think of as the traditional pockets of entrepreneurship. The finalists for this program included accelerators from towns as small as 1,000, many run by (and sometimes focused on serving) women or minorities, from ares of the country looking to reinvent themselves and join the new economy, to accelerators that were leveraging historical manufacturing capabilities into the new economy. It was an impressive collection of people and stories, all with a common passion for helping entrepreneurs.

I left the day feeling as optimistic as ever about the role entrepreneurship plays in our economy and excited about how strong the entrepreneurial ecosystem is across our country. I was also impressed by the passion that the team from the SBA has for supporting small business (not to mention the pretty amazing group of people they put together to review the applications). I get that it’s their charter, but this goes beyond that. This program isn’t universally loved within the government and I applaud the team I worked with at the SBA for making it happen.

Update: Here’s the link to the SBA announcement of the winners of the competition.

Some more data on Venture outcomes

Quick update here. The data I site below is from Foundry LP StepStone. Since my original post I’ve confirmed with them that they’re ok with my identifying them as the source of the data. And they’ve offered to help me play with the raw data of a future report – I’ll work on some interesting updates here soon!

Yesterday’s post on venture outcomes – Venture Outcomes are Even More Skewed Than You Think – generated lot of traffic. Clearly, it’s interesting to put real data against a heuristic and see how reality maps to our expectations. As I pointed out in my post, the data set from Correlation Ventures I was working with had some limitations. For starters, I didn’t have the raw data to run my own cuts of the analysis. And more importantly the data were financing level, not company level. A bunch of people asked me about this and I’m working with Correlation to see if the next time they do this analysis we can get a few different views of the data.

In the meantime I went poking around for some additional information and remembered an analysis that one of our investors sent me on roughly the same subject. I thought given the interest in my last post I’d put it up for further discussion. Still not exactly how I’d parse this if I had access to the full data set, but interesting nonetheless. This analysis is on a company basis, not a financing basis (the chart is labeled “Deal” but in this case that means company, not round). I should also note that its skewed a bit towards better performing funds. This was an internal analysis by an LP so I’m not able to release the full report but the data set represented over 3,000 companies and more than $20Bn in invested capital and spanning years 1971 through 2012. The data only represent companies that have exited (and not, for the more recent fund vintages, companies current carrying value). It’s also worth noting that this data set likely shows a slight upward bias, reflecting this LPs selection over the years of better performing funds vs the VC average (from the internal report: “In our view, the data set is skewed toward higher quality funds; the average returns of these deals across vintage years outperform the VC average.”).

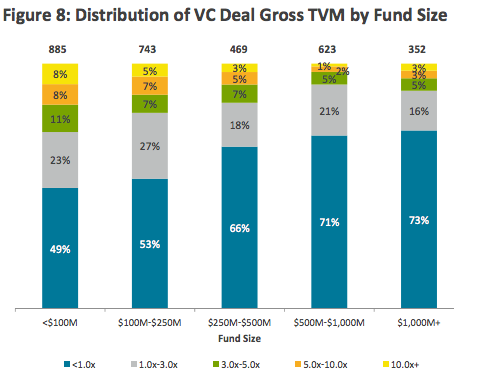

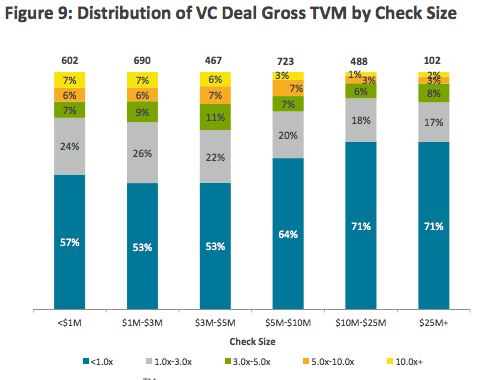

The first chart below shows the distribution of venture outcomes by fund size. Interestingly, the loss ratio of smaller funds (where outcomes are <1x) is smaller as a percentage of the portfolio than for larger funds. 49% of deals for funds smaller than $100M fail to return capital, while 73% of deals from larger funds failed to do so. The top end showed the same trend between small and large funds – smaller funds were significantly more likely to produce exits of 5x or greater vs large funds. These data largely track to investment size with larger checks producing not only fewer outsized winners (as you might expect given the nature of larger rounds) but also producing far more companies that failed to return capital (which you might not expect given the nature of the types of deals that raise larger amounts – stage, risk profile and investment structure).

One obvious conclusion from these data (and something I’ve seen supported by other data sets as well, although I haven’t written about directly before) is that smaller funds outperform larger funds. There’s more to that argument than is contained in the charts above (with well in excess of 50% of all deals failing to return capital, there’s plenty of devil in the details to make that conclusion) however the report I pulled these from – the writers of that report had the full data, of course – clearly articulated that as one of their conclusions. More on that in a separate post at some point. These numbers generally support the conclusions I drew yesterday about the challenge of finding unicorn investments. But the data also suggest that while they don’t truly follow the 1/3, 1/3, 1/3 heuristic, smaller funds come closer to that hypothetical portfolio distribution than do larger funds (at least above average funds do). In this data set, funds smaller than $250M invest in companies generating greater than 3x return 23% of the time and fail to return capital on a little over 50% of their investments. This compares to less than 10% of investments by funds greater than $500M generating a 3x return and almost 72% failing to return capital.

All of the data aside, it’s clear that venture returns are generated by a minority of funds that find themselves in the outlier deals (and that being a successful venture capitalist is quite difficult).

Venture Outcomes are Even More Skewed Than You Think

The typical “successful” venture portfolio is often described as having the following outcome:

- 1/3 of companies fail

- 1/3 of companies return capital (or make a small amount of money)

- 1/3 of companies do well

Fred Wilson, for example, described this a few years ago:

I’ve said many times on this blog that our target batting average is “1/3, 1/3, 1/3” which means that we expect to lose our entire investment on 1/3 of our investments, we expect to get our money back (or maybe make a small return) on 1/3 of our investments, and we expect to generate the bulk of our returns on 1/3 of our investments.

It’s a generalization but one that’s pretty well accepted in venture circles and it’s how many VCs describe target fund distribution, myself included. But does this heuristic match reality?

Actually no.

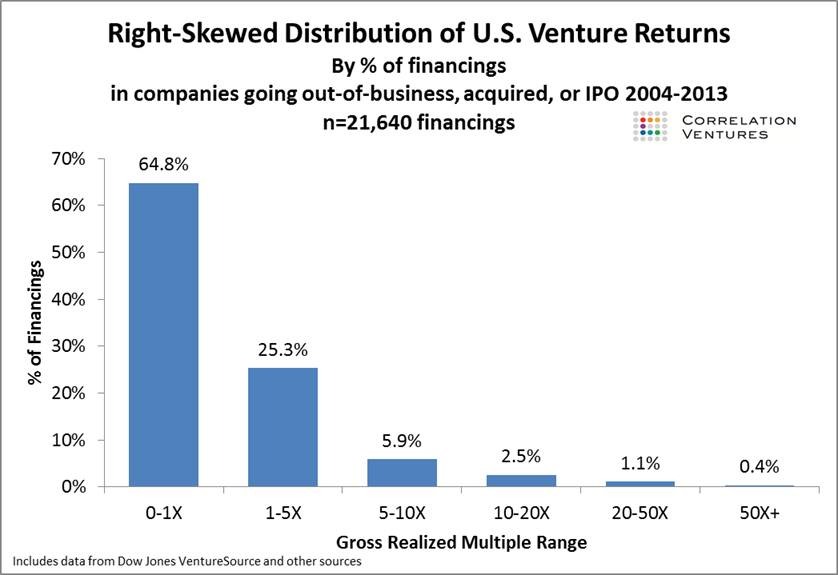

Correlation Ventures just released a study that shows the distribution of outcomes across over 21,000 financings and spanning the years 20014-2013. For those of you that don’t know Correlation, they take a data driven approach to co-investing – essentially creating an algorithm that predicts the success of a company based on a number of factors that include both business trajectory as well as financing trajectory (we’re co-investors with Correlation in Distil, for example). The result is that they process a lot of data. Which leads to some pretty interested insights.

Based on their data, a full 65% of financings fail to return 1x capital. And perhaps more interestingly, only 4% produce a return of 10x or more and only 10% produce a return of 5x or more. These data suggest that the heuristic I site above potentially presents a rosier picture of the venture industry than reality suggests is the case (there are some missing data here in that the vast majority of companies are in the 0-1x category but the data within that category weren’t released – but my suspicion is that within that category the distribution of outcomes follows a similar power curve).

This really underscores the challenge of creating a venture portfolio that produces reasonable returns. If you were to actually construct a portfolio based on these averages, a $100M venture fund investing in 20 companies would produce a gross return of approximately $206M (that’s before fees and expenses). The resulting fund would have an IRR in the range of 10% (the exact IRR would depend on the timing of the cash flows, but I constructed a few models to approximate this and 10% was the average return). That’s hardly something to write home about and underscores the challenge of being “average” in this industry.

Hidden in this exercise – and perhaps more important – is the challenge of finding companies at the right side of the distribution chart. In my hypothetical $100M fund with 20 investments, the total number of financings producing a return above 5x was 0.8 – producing almost $100M of proceeds. My theoretical fund actually didn’t find their purple unicorn, they found 4/5ths of that company. If they had missed it, they would have failed to return capital after fees. Even if we doubled the number of portfolio companies in the hypothetical portfolio, a full quarter of the fund’s return comes from the roughly ½ of a company they invested in that generated 10x or above. Had they missed it, they would have produced a return that roughly approximated investing in bonds – not the kind of risk adjusted return they or their investors were looking for.

It’s important to note here that I’m extrapolating a bit – the Correlation data are based on financings, not companies (I asked – they didn’t have a sort at an entity level in this exercise). I thought about ways to normalize this but came to the conclusion that the best normalization was to use the raw data and caveat that it was financing level, not company level. I’m going to work with Correlation to get entity level detail the next time the do this exercise.

All of this math simply underscores how important winners are to venture returns and how difficult it is to find them.

Note: An obvious, but important, thank you to Correlation for allowing me to share these data as they were originally prepared as a private exercise for Correlation and their venture partners. As I mention above, we’re coinvestors with Correlation in Distil Networks. They have a bit of a unique model for co-investing which allows them to see a lot of data on a lot of companies to support their data driven investment thesis (which also allows them to reach fast investment decisions).

It’s time to get away

As we approach August, and having recently taken some time off myself (some real time off this time – more on that experience in a different post) I thought it might be a good time to talk about the importance of vacation.

As we approach August, and having recently taken some time off myself (some real time off this time – more on that experience in a different post) I thought it might be a good time to talk about the importance of vacation.

No – this isn’t going to be a post that waxes poetic about the importance of recharging and how the startup culture is totally fucked up in its crazy work ethic. All true, but I’d actually like to approach the question here from a purely business perspective.

For years I’ve encouraged startup execs (especially CEOs but this advice flows down the chain as well) to take time away. Completely away. No checking in once a day on email. No calling into the management standup. Just gone. If that’s a week, great. If you feel you can’t get away for that long, try a long weekend (but seriously – you can’t take a week off?). Just make yourself unavailable for a bit.

You’ll get some nice down time. But just as importantly, you’ll learn a lot about what isn’t working at your business and specifically where you’ve set yourself up as a bottleneck. What decisions don’t get made in your absence? What projects grind to a halt? Which managers step up and which are hand-tied without you around to bounce questions off?

Every CEO I know who has tried this has come back and made changes to how they manage their business based on what they learned through the experience. My guess is that you will as well.

Syndicate Funding on AngelList – A Company’s Perspective

A few months ago AngelList announced Syndicates – enabling investors on AngelList to create fund-like groups of investors to invest together in AngelList companies (following a single lead investor). It’s a great idea and at Foundry we quickly decided it would be an interesting experiment to form our own syndicate. We were the first formal venture fund to do this. Since then we’ve completed about 10 deals (I say “about” because we have a few things in various stages of completion as I write this – the intent of FG Angels is to make 50 AngelList investments – about 1 per week).

We often get asked how the process works and while what’s below has specifics about working with FG Angels it also contains some great advice for anyone raising money on AngelList in general, and through Syndicates specifically. I’ve edited the text and added some things of my own, but this is largely the work of Carrie Requist, CEO of UGrokit, a company we recently funded through FG Angels.

How AngelList Syndicates (and FG Angels) Works

It’s important to understand that AngelList syndicates work somewhat like an opportunity fund, where AngelList investors sign up to “follow” a syndicate and pledge to invest a certain amount of money. The key here is that this isn’t a hard commitment – each syndicate member makes a deal by deal decision to invest. As a result the syndicate size isn’t the total amount of money you’ll raise – it’s the maximum you’ll raise from the syndicate. And depending on how many members there are to the syndicate and what crowdfunding exemption you use (more on that below) the actual limit will likely be quite a bit less than the total you see next to the syndicate name on AngelList. And, of course, it will also require some work on your part to pull syndicate members into your actual deal. Syndicates aren’t automatic capita – you’ll still need to work for your money.

There are 2 parts to the FG Angels or any AngelList Syndicate investment:

- Foundry Group (or your syndicate leader) invests their portion – in FG Angels case this is $50,000

- In parallel they open the investment to their syndicate members on AngelList

AngelList shows for each syndicate the amount that the syndicate leader will invest and the amount pledged by all the syndicate members as a whole (shown as “backed by” on AngelList). At the time of FG Angels investment in U Grok It, their syndicate total was $426k (that total excludes the FG Angels portion).

It’s worth reiterating that unlike a mutual fund, the investors are not committed to investing in every company that any syndicate backs, so the $426k from the members of FG Angels represents the maximum investment if every member decided to contribute (and again, as a practical matter given the number of members in the syndicate and the exemptions that AngelList relies upon to fund these syndicates the actual maximum is below this number). Members have not given any money to AngelList or FG Angels for the syndicate and ultimately, the investor must make their own decision on each deal and then transfer money on a deal by deal basis. Many things can effect your actual deal participation including how many deals the syndicate has completed, the pace of the syndicate’s investments, the type of investment (ie., note or equity), the stage of the company, how much the company is raising, specific deal terms, and members personal preferences.

U Grok It was actively raising on a convertible note and had already closed a portion of it, so we already had terms in place. Foundry reviewed these terms before committing to invest and both FG Angel’s $50k and the syndicate member’s total amount are under the terms of this note. This means we did not negotiate deal terms with Foundry or with AngelList, the investors accepted the terms we already had for the convertible note (or choose not to invest). There are syndicate deals where the lead investor does negotiate terms (Foundry does this on other FG Angel deals) but syndicate members don’t – they either accept the terms or don’t participate. And they do look at terms so structuring a fair deal is important.

Syndicate Dynamics:

To sign up for FG Angels, an investor must be approved by Foundry Group and agree to their terms, which include a carry. The carry is a percentage of the returns on the investment that the investor will give to Foundry Group for managing the syndicate and investments (note that AngelList itself takes a carry as well). The carry is between Foundry Group and the investor and has no direct impact on the AngelList company. This is beneficial to the startup because neither AngelList nor Foundry Group take any of the investment funds -there is no “finders fee” or other fee to the startup for being part of the syndicate. FG Angels and AngelList will get their carry straight from the syndicate investors upon an exit. The terms for being a syndicate member and the specific carry vary between syndicates, but the key for founders here is that this is all taken care of outside of any specific investment and any investor listed as part of the syndicate will have already agreed to the terms and carry.

The AngelList syndicate shows the number of members in FG Angels and lists each syndicate member as well as the amount they have pledged per investment. There is a portion of syndicate members who rarely invest in any deals and some who invest in every deal. A smaller group performs due diligence on each deal before they invest and makes a deal by deal decision whether or not to participate.

The Timing:

FG Angels Syndicate investments go FAST. Foundry committed to invest through FG Angels on a Friday. Over the weekend we revised our note and updated our AngelList profile. On Monday our deal went live and almost all the funds raised from the FG Angles syndicate were in process by the following Monday (within one week).

Be Ready for the Syndicate Investment to go Live on AL:

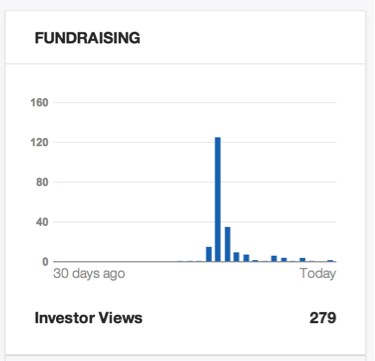

FG Angels is a popular and fast moving syndicate with 219 members at the time of the U Grok It investment – with an explicit goal to launch a new investment each week. This means that the interest in your startup will shoot up as soon as the FG Angels investment goes live on AngelList. Here is a graph of the investor views on U Grok It’s AngelList profile over the two weeks that the FG Angels Syndicate investment was live:

The first short bar is the Monday it went live (we launched towards the end of the day). The big spike is Tuesday. What this means for an AngelList company is – be completely ready for investors before giving FG Angels the green light to go live.

The first short bar is the Monday it went live (we launched towards the end of the day). The big spike is Tuesday. What this means for an AngelList company is – be completely ready for investors before giving FG Angels the green light to go live.506(b) vs 506(c):

These refer to two of the SEC rules that regulate “crowdfunding” financing. 506(c) is the new Jobs Act provision that, in part, allows for what’s called a general solicitation (on AngelList, this is shown as a “public” fundraising). FG Angels Syndicate investments are NOT general solicitations and some syndicate members do not want to invest in companies that are using this exemption. Check with your lawyer to make sure you have not engaged in general solicitation and make sure you DO NOT CLICK on the AngelList button that says “Activate” under “Raise Online On Your Own.” (this can’t be undone, so make sure you’re careful about this step). Your AngelList company profile shows “Investors Only” in the upper right under Fundraising if you are 506(b), which is likely you want (this isn’t legal advice – talk to your lawyer about the pros and cons about the various exemptions but understand that, broadly speaking, few institutional investors will ever invest in your company if you use the new broad solicitation rules – they simply don’t work as intended (yet).

What the FG Angels Syndicate Wants to See:

Closing an investment is just another form of closing a sale for your company. Investors just have a different pain they are trying to solve – they want a big return on their investment. Make sure your investor messaging is clear on this in your AngelList profile. Be sure to have your profile polished. For example, you’ll want:

- Video of your deck – if you have a good quality video of yourself presenting your deck, great. If not, record your audio and put that with your slides. We did this in house (the production quality does not have to be stellar, just clear) and put it as an unlisted video on YouTube. You can then put the link in AL.

- Product demo video

- Product shots / screen shots

- Every part of your profile completed

- Current investors and total investment amount for this round. AngelList will show how much you are raising and how much is left in the raise, so make sure the numbers are up to date by updating each closed investor prior to launch

- AngelList comments and references for both your company and the founders. If you don’t have these, ask for them. Your networking should have brought you into contact with many people who are rooting for you – this is a way they can help you without investing money. We had some high profile supporters who gave us comments just before the investment went live and this was a big help

- Your website – Make sure your website is up to date because the FG Angels Syndicate members will go from AngelList right to your website to see what your customer messaging looks like and how you position your business.

What Happens After the FG Angels Syndicate Investment Goes Live:

You will have a lot of fundraising work to do in the week after the investment goes live. Members start to make reservations in the investment – you’ll see that is shown in the activity for both FG Angels and your company on AngelList. Members can also increase the amount they want to invest in your company. Members can also withdraw or cancel from the investment.

AngelList will show your company as having raised the total backing amount of the syndicate (which is overstated for the reasons already discussed) and separately show the total backing amount + FG Angels $50k. These are shown on your company’s Stats page > Fundraising > Manage > Overview. This total will initially be the full backing amount of the FG Angels Syndicate and will go down slowly as members withdraw (yes, slightly disheartening). Remember that this will be a good investment both from the funds standpoint and by having Foundry Group’s support.

Note that most FG Angels members will neither reserve nor withdraw. Your company will also get a lot of follows (mostly from FG Angels syndicate members) and a lot of request for intros. You should follow everyone who follows you and have a message prepared to send to each one. U Grok It’s message thanked them for following, invited them to watch the pitch deck and demo videos and to contact us with any questions, giving direct contact information. Also reply to each request for intro and expect these people to email you back, usually with questions. The request for intros are often investors who do more diligence about the investment. Some followers and request for intros are from investors who are not members of the FG Angels Syndicate, but watch what the syndicate does to find new investments. Plan that most of the your week after the FG Angels Syndicate investment goes live will be spent courting AngelList investors.

In our case, we were also contacted by people who follow FG Angels or one of the Foundry partners but who are not part of the FG Angels syndicate. These people can become outside investors (we are still conversing with a few that may be interested in our Series A round). Some syndicate members may also wish to invest directly in addition to their participation in the syndicate. U Grok It has a new investor in this round who has a small amount in the FG Angels syndicate, but is investing substantially more directly (this is a bit of an end around Foundry, so be careful here who you let in and whether they’re trying to simply piggback on FG Angels w/o paying the carry associated with doing so or if they’re legitimately interested in participating in the syndicate and so excited they want to invest more). So don’t discount a syndicate member just because their syndicate participation may be low. Also to this point, less than half of our syndicate investment came from investors at $5K or higher. The majority was at $2,500 or lower.

Closing the Investment:

At your direction, AngelList will begin to close the FG Angels investment. This will allow syndicate members to start transferring their investments into the fund (more on this below). AngelList will then select a closing date (about a week after you start closing). Our investment opened on Mon, March 24 and AngelList started closing on Wed, March 26 with an initial closing date of Tuesday, April 1.

Here is where you start to get an indication of how much you will actually raise from the FG Angels syndicate. Members will start transferring their investment and in the Stats > Fundraising > Manage > Manage page you will see the amount that has been collected (starts as $0) above a four-tabbed list: All, Not Started, Pending and Collected. In the “All” list, you will see only the members who have not previously opted out of the investment and then you will see some members cancel.You will see the pending amount increase and then the collected amount increase as the pending amount decreases (funds move from pending to collected). Starting to close doesn’t lock anyone out of the investment. Any member of the syndicate (even if they did not opt in, as most of them didn’t) can transfer their investment during this part of the closing. AngelList will send a message to the FG Angels members when the investment starts to close and another one a few days later reminding them to transfer their funds.

This is a great time to update the FG Angels Syndicate members in the Not Started group. If you ask AngelList, they will send you a spreadsheet of the members with their email addresses so you can do a group BCC: email with send you the link they need to click on to make their investment. Include some update on your company (in our case we received a new, glowing profile from a high profile AngelList member and we were opening our online sales). Come up with something to update them about. Make sure this email goes only to the Not Started group. AngelList is also generally happy to extend the closing date if your pending investments are still going up. We extended from April 1 to April 7, but the vast majority of the investment was in Pending by April 1. When investments slow or stop (in one to two weeks), AngelList will close the investment – this does keep members who have Not Started from joining the investment, but keeps things open until the pending investments have been received.

The Investment Paperwork and Details

The FG Angels Syndicate investment is overseen by Foundry Group (for which they receive the carry if the investment generates a return). The company will have only two new investors: FG Angels and FG Angels Syndicate. The FG Angels Syndicate members who invest in your company become part of a fund setup by Foundry Group through Assure Fund Management. Someone from Assure will contact you after the FG Angels syndicate investment goes live on AngelList to set up your funding vehicle (this is separate from FG Angel’s direct $50k investment).

If you have filled your round and are closed, that is great. If you still have room in your round (we did since we had extended the round to ensure there was enough room for the FG Angels Syndicate), then you can keep raising.

CONGRATS – Now What? – Investor Relations with the Syndicate

Technically, you only have FG Angels and fund(s) managed by FG Angels as your investors. However, some syndicate members will want to connect with you directly (in our experience often on LinkedIn), some will ask for updates and some will offer their help (services, connections, advice).

This is evolving so there aren’t really any norms here yet. On the one hand, it is impossible for a small startup to effectively manage 100 new investors. On the other hand, these investors all now have a stake in your success and many are willing to help make that success happen, so they can be quite beneficial to your startup.

You can send updates to the syndicate investors as a group through AL in Stats > Fundraising > Manage > Manage where, once the deal is finalized, you will see a list of Closed investors and Didn’t Close and on the right a Message box with a link to “Update Investors or ask for advice.” These updates are only visible to you and your investors. We updated the investors when the round completely closes and plan on providing them major updates and perhaps a quarterly post while right now I send out a monthly (or so) email to our direct investors as well as field calls and make calls when there is a topic to discuss.

Hopefully this overview is helpful in gaining an understanding of the AngeList syndicate process in general and the FG Angels process in particular. Of course this is a new and therefore evolving method for funding your business so check for updates from AngelList (and here where we’ll post new developments).

Taking the long road

I first met Carrie and Tony Requist of U Grok It in February of 2012. We were hosting a DEMO event with VentureBeat and UGrokIt was one of a handful of companies that was chosen to come in and pitch. I remember the U Grok It presentation well for a number of reasons. For starters, Carrie and Tony are married. And living in Steamboat. Both pretty unusual for the startup world. And they were building a simple smart-phone based RFID reader with the idea of creating a consumer product that would allow individuals to easily and cheaply track their stuff – a problem I’m quite familiar with as I have an uncanny propensity to misplace things (there was much joking in the meeting about this, in fact).

I first met Carrie and Tony Requist of U Grok It in February of 2012. We were hosting a DEMO event with VentureBeat and UGrokIt was one of a handful of companies that was chosen to come in and pitch. I remember the U Grok It presentation well for a number of reasons. For starters, Carrie and Tony are married. And living in Steamboat. Both pretty unusual for the startup world. And they were building a simple smart-phone based RFID reader with the idea of creating a consumer product that would allow individuals to easily and cheaply track their stuff – a problem I’m quite familiar with as I have an uncanny propensity to misplace things (there was much joking in the meeting about this, in fact).

I stayed in touch with them after that first meeting and occasionally Carrie would swing by Boulder on her way in or out of town to update me on the company’s progress. As many businesses do, U Grok IT took many twists and turns as they figured out how to turn their prototype into a production unit and honed in on what they eventually found was a much larger opportunity – providing a enterprise class (but still smartphone based) RFID reader that was an order of magnitude cheaper and significantly easier to use than the special purpose units that had been on the market relatively unchanged for the past 15 years. All this while scrapping funding together on an almost continual basis.

I was impressed – mostly with their scrappiness but also with the progress of the idea and the business. And as I sat listening to the latest update about a month ago I finally had the right mechanism through Foundry’s FG Angels syndicate to actually support them and the business.

I wrote a post a while ago about the 10 year entrepreneur that described the often long, less celebrated journey typical of most entrepreneurs as they built their businesses (contrasted with what sometimes is glorified in the tech press). The story of UGrokIt’s funding is in the same vein. Perseverance in the business and in continuing relationships pays off. I’m excited to be working with Carrie, Tony and the entire UGrokIt team.

Why doesn’t British Airways Want to Make Money?

British Airways parent company finally got back into the black in 2013, presumably benefitting from an increasingly favorable global economy. They certainly were not benefitting by their own policies as I unfortunately found out recently. I’m writing this post in the hopes of gaining an explanation for why BA would behave so stupidly.

British Airways parent company finally got back into the black in 2013, presumably benefitting from an increasingly favorable global economy. They certainly were not benefitting by their own policies as I unfortunately found out recently. I’m writing this post in the hopes of gaining an explanation for why BA would behave so stupidly.

Here’s the quick summary:

A few months ago I purchased tickets from BA that were basically two round trips (one inside the other). The BA website priced them for me at the lowest available fare that included the normal fare restrictions around changing the tickets or getting a refund (changes would incur a fee and there were no refunds – got it). The disclosure on their site was minimal and there was no obvious way to buy a less restricted fare. I knew at the time I might not take the middle round trip but I wanted to lock in the tickets.

Fast forward a few months and I decided that there was a better way to travel the “middle” trip so I called up BA to tell them that I wasn’t going to take the outbound leg of that segment. I didn’t ask for any money back for the unused tickets – just wanted them to know that I wasn’t going to use them and that they could cancel them and resell them to someone else. (I’ve done this plenty of times for US domestic flights and never had a problem)

And that’s where it all fell apart.

“No no,” I was told. That’s a “change” to your itinerary and to do that I’d need to pay a large change fee for the privilege of not taking the flight. What?!? I’m not changing any flights – I’m giving them back something of value. And as it turns out that flight is nearly sold out – they have a small number of tickets left for a 1-way fare of US$ 200. They need the ticket and will likely resell it and I don’t want it. But no. BA insists that not taking a flight is a “change” and my only choice is to pay or show up (if I don’t they’ll cancel the remainder of the itinerary).

This is completely crazy to me. British Airways has a simple and easy opportunity to both make more money and make a customer happy (not to mention make things a whole lot easier for me). Instead they’ve decided to make less money and completely alienate a heretofore happy customer (and you can be sure that if they don’t change their view on this, this will be my last BA flight). Not to mention that I’m not “changing” a flight or trying to rebook a ticket (which would clearly trip the change clause). I’m keeping every flight the same – just giving them back one leg of the trip.

Make more money and have a happy customer; make less money and lose a customer for life. That’s a difficult one.

The supervisor I talked with kept telling me that it “wouldn’t be fair” to other customers who had paid a higher ticket price. He also (quite rudely) kept telling me that I had such a low fare that I shouldn’t expect anything different (lowest fare or not, the ticket certainly wasn’t cheap). And remember that the BA website didn’t give me an option of buying any other fare for these flights (I tried that again today to the same result – they show only the lowest fare available and there’s no opportunity to pay more for a more flexible ticket – at least not an obvious way).

This makes absolutely no sense to me. Maybe you can help me understand the logic.

Camp DevOps! (at Gluecon 2014)

One of the big uptrends in technology is the rise of DevOps. Whether your organization is a large enterprise or a fledgling startup, DevOps can help. We have seen this first hand in many of our portfolio companies and the market in general. This is why we are excited to be working with Eric Norlin and the Gluecon team and DevOps.com in bringing Camp DevOps to Boulder on May 20th.

Camp DevOps is a follow up to the successful DevOps conference we help host last fall here. That conference was very well received and we think Camp DevOps will be even better. Held at CU Boulder Atlas building, it is a full day chocked full of DevOps. There will be keynotes, technical tracks, business tracks, panel discussions and something called “Hello World” which are hands on technical training sessions.

The lineup of speakers for the show is great with keynotes from Sanjiv Sharma of IBM (and author of DevOps for Dummies), Rajat Bhargava of JumpCloud and Howard Diamond of MobileDay. Plus we’ll be there! You can see a full lineup of speakers and register at http://CampDevOps.com

The show is only $49.99 and that includes breakfast and lunch. If you are already going to Glue admission is free. Also if you buy the admission for Camp DevOps you receive a $100 credit for Gluecon as well.

This will be a great event for the Boulder community on a subject that is near and dear to many of our companies. Hope to see you there!