The 4 Keys to a Successful Angel Investment Strategy

With the increasing popularity of angel investment sites such as AngelList and CircleUp more and more people are making investments. I love this trend and have a longer form blog coming on the subject – which I think is massive positive force in the startup ecosystem. But this post is much shorter and to the point.

I often get asked what my thoughts are on angel investing. Here are what I think are the 4 keys to a successful angel investment strategy:

1) Take a portfolio view of angel investing- put aside a pool of money and plan to make 10 or more investments. One-offs simply don’t make sense in this market (too much alpha)

2) Be willing to lose all your money (and assume you will) – mortality rate at the angel stage is extremely high

3) Be passionate about either the team, the idea or both. You should be in love. Angel investing is about emotion, not logic.

4) Don’t reserve/follow. Your job is to put in seed capital. The company’s job is to grow the business and find new capital. They either do this and are successful or don’t and you write it off. I don’t think it’s wise to play the pro-rata game at the angel level.

Just say NO to that large fundraise

I wrote a post a few years ago about using your lack of funding to your competitive advantage. The basic gist was that all businesses act within constraints and that the discipline that can result from having less money that a competitor – if you embrace it – has the ability to sharpen your focus, avoid the temptations of distraction and be more thoughtful about how and when you spend the precious cash that you have.

I was reminded of that post recently when engaged in a debate about how much money a company should raise. The knee-jerk reaction is often “as much as they can!” And while that might sound satisfying, it’s often not the case. At Foundry we’ve been fortunate to be involved with a number of businesses that have taken advantage of the ability to raise a war-chest of cash. And when you’re going big, and have reached proof points where you can now spend money with a specific plan in mind (and the metrics to back it up) this often makes sense.

But not always.

Much less is talked about the null case. Those companies that could raise larger round but opt not to. We’ve had a number of those in the portfolio that are – by the nature of having not raised a eye popping round – much less talked about. While a whole lot less sexy and certainly not as buzz-worthy, NOT raising a large amount of capital very often makes as much (or more) sense than raising “as much as you can.” A few thoughts on why:

– For companies that are cash flow positive and already growing about as fast as they can keep up with (yes – there are plenty of these businesses around and yes – adding more cash doesn’t always equate to more growth) there’s often simply not a compelling need to over-raise. Think growing at the right cost vs. growing at all costs. One optimizes spend and trajectory. The other wastes money.

– Large rounds bring new investors and a different investor/board dynamic which can be a challenge to manage, especially for a fast growing business

– Importantly, those new investors and their large piles of cash bring with them lofty exit expectations. Often times companies are better served raising a smaller amount of money from existing investors to keep all of their options open – especially as they transition from start-up to mid-stage. I’ve watched this literally kill a company.

– Large balance sheets beget large spending (see my post I referenced above on being scrappier than your better funded competitor). The world is littered with companies that raised too much, then spent too much. And while you can certainly keep your discipline with a large balance sheet it’s pretty easy to get off track.

More than anything, its important to note that there’s a choice here. One isn’t better than the other – despite the market perception. Make your own choice and don’t get caught up in the hype.

Entrepreneurship behind the wall: A trip to Palestine

If you’ve been a reader of my blog for any time you’ll know that I’m intrigued by (and a big fan of) the notion of The Democratization of Entrepreneurship. It’s not that I think entrepreneurship solves all the world’s challenges, but I deeply believe in the notion of entrepreneurship as a catalyst for positive social change across the globe. It’s a powerful force and we’re seeing more and more examples of entrepreneurs creating real change around the world, community by community.

If you’ve been a reader of my blog for any time you’ll know that I’m intrigued by (and a big fan of) the notion of The Democratization of Entrepreneurship. It’s not that I think entrepreneurship solves all the world’s challenges, but I deeply believe in the notion of entrepreneurship as a catalyst for positive social change across the globe. It’s a powerful force and we’re seeing more and more examples of entrepreneurs creating real change around the world, community by community.

Late last year I had the opportunity to spend a week in Palestine working with entrepreneurs and traveling in the region. It was part of my work as an advisor to Sadara Ventures – the only Palestinian focused venture fund (Google, Soros, the EU, Skoll Foundation and others are investors in the fund). It was an eye opening trip to say the least and a truly amazing experience to be working with entrepreneurs in an area that is experiencing so much turmoil.

This is a personal story and one about entrepreneurship. But it’s impossible to tell that story without the context of the political reality on the ground. In fact everything in Palestine to some extent takes place with that backdrop (and perhaps – at least as it relates to business and investment – in spite of it). I’m in no way trivializing the conflict nor suggesting that the answers to the region’s problems are easy ones that can be fixed if we only better supported entrepreneurs. But it was refreshing to spend time with people living literally behind the wall, but looking past the political situation to try to create an environment in which entrepreneurs can survive and thrive. While in Palestine I had the opportunity to work with a number of entrepreneurs, meet with locals in shops and restaurants, but also to meet with a handful of key business leaders as well as the Vice President of the Palestinian Authority. The perspective I gained was a true cross section of Palestinians and as varied as the backgrounds of the people I met.

A little background and context. Palestine can be a rough place. GDP per capita is low – about US$ 1,650 per capita. The overall labor force participation rate is only 43% and unemployment is over 20%. The population is very young – 70% are below the age of 30 (and 40% younger than 15) and youth unemployment is over double the overall rate.

Movement in the territories is pretty restricted (and here I’m referring to the West Bank and not Gaza, which is completely closed off). The West Bank itself is about 5,600 square kilometers (so not exactly tiny) but movement into and out of the territory is difficult. As a foreigner I could come and go as I pleased (as a side note, getting into the West Bank was much easier than getting out – really meaning getting back into Israel; the very heavily armed Israeli soldiers weren’t all that impressed with my US passport, nor I suspect my very Jewish sounding name given where I was coming from). Some Palestinians do have papers that allow them to travel into and out of the West Bank (particularly those born in/living in East Jerusalem which is an area in dispute, but is on the Israeli side of the wall). Israelis are restricted from entering Palestine – by the Israeli government (presumably concerned that any violent act by or on an Israeli would case a political storm) – and several of the Israelis associated with Sadara had to obtain day passes to enter and exit (they were denied the ability to stay overnight in Palestine and instead had to drive back to Jerusalem each night; I was able to stay in the center of Ramallah at what turned out to be a pretty nice hotel). Cars in the West Bank are restricted to the territory if they have a white license plate but can access Israel if they have a yellow one. Even in Israel travel is a somewhat restricted with frequent check-points on the main highways (traffic slows, but does not stop through these).

Entrepreneurs in Palestine are like entrepreneurs everywhere – optimistic, hard working, a tad fanatical at times. And while many of the businesses I was helping with were building products targeted to the Arabic speaking world in the EMEA region, the businesses they are creating would be familiar to any entrepreneur – travel and hotel bookings, content for kids, a gaming platform, 3D rendering systems, etc. It’s that passion for their projects combined with their desire to build businesses in Palestine that really stuck out to me from my visit. Many of the entrepreneurs I met with were educated in the US or Europe and had papers that would have allowed them to start their businesses elsewhere. But they’ve chosen to come back to Palestine to work there in an effort to try to make a difference in their homeland. Many spoke eloquently about this choice and the decision to move back home. I have a lot of respect for that kind of national pride. But especially in the context of the political situation in the West Bank where another Intifada would put the region again in a tailspin – business leaders in Palestine talk openly about wanting to avoid this but also with the understanding that there was little anyone could do to either predict or prevent another uprising (although they also recognized that economic stability leads to greater political stability).

I left Palestine completely energized about the work going on there in the entrepreneurial community and hoping that I can continue to help pursue economic development in the region.

What follows are some images from my visit as well as some background about them.

Video from the “no-man” zone on the Palestinian side of the wall but not yet truly in Palestine (the Israelis set this area up basically as a buffer to Israel but its become this sort of bizarre in-between land that’s neither a true part of Israel or Palestine. There are several refugee camps just to the south of this area that we passed on our way in.

The difference between the Israeli side of the wall and the Palestinian side makes it clear who erected the barrier. The Israeli side is pristine while the Palestinian side is covered with graffiti.

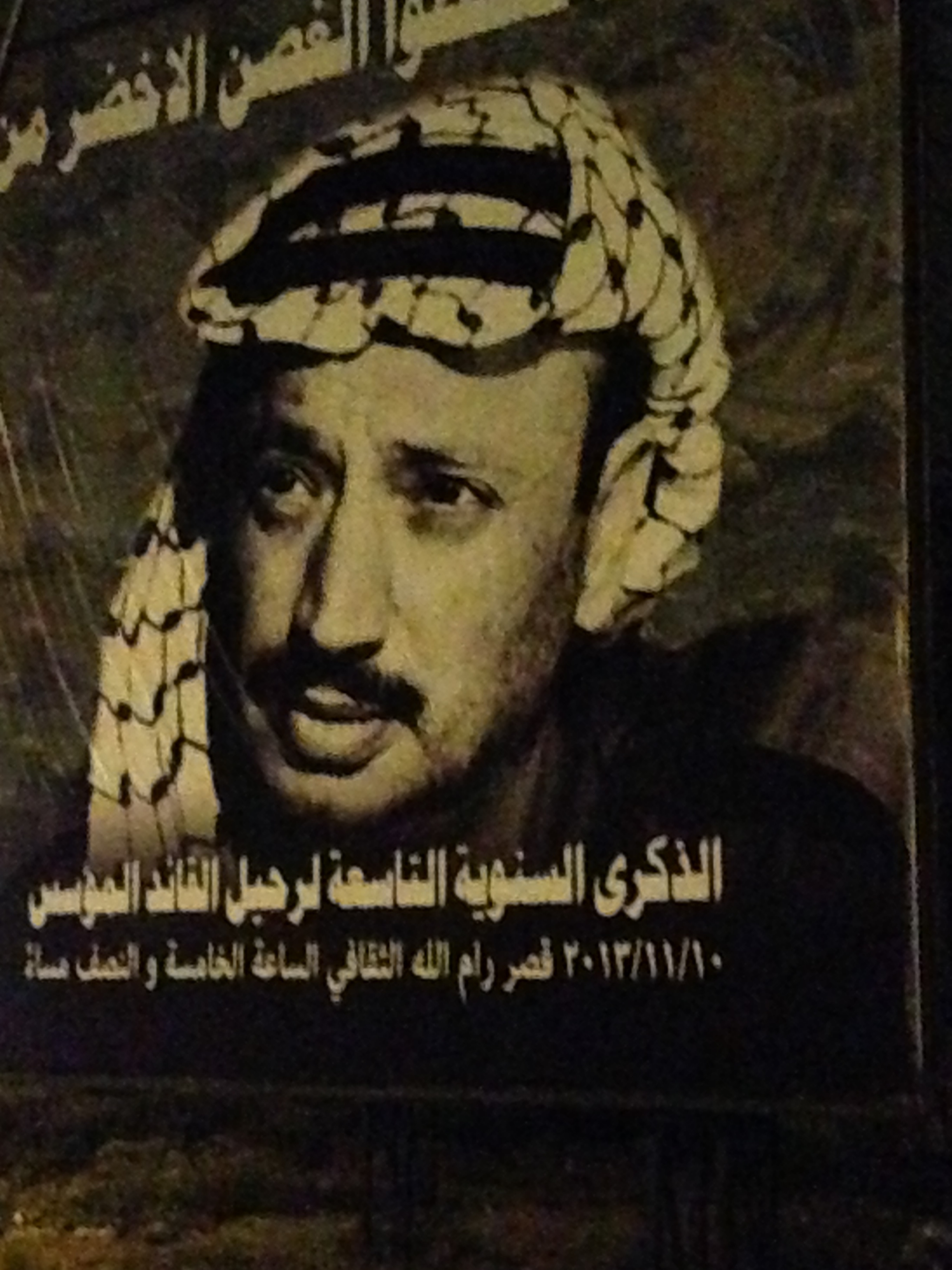

Pictures of Yasser Arafat are everywhere in Palestine.

I was fortunate to have the opportunity to have lunch with Dr. Mohammad Mustafa, Vice President of the Palestinian Authority. He’s widely talked about as the next PM of the Palestinian Authority. Interesting to say the least (my visit happened to coincide with a visit to the region by John Kerry, the US Secretary of State). The details aren’t appropriate to get into, but Dr. Mustafa has an economics background (he was trained in the US and worked for 20 years in Washington) which I think lends itself to a pragmatic view of the world. Although even with that, the severity and length of the conflict leave even practical thinkers on both sides at odds over certain of the most difficult points of contention.

I had a chance to tour Jerusalem for half a day. It was my first time in Jerusalem – obviously a city rich with history. The pictures below include me at the Western Wall as well as some of the marketplaces and architecture around town.

My tour guide in Jerusalem said something to me that, while I hope isn’t true, really stuck out to me. We had just gone through the Church of the Ascension and were ending our tour. Sitting on the steps of the Church I said to him: “You seem like a pretty reasonable guy and you’ve lived here for something like 20 years, what do you think the solution is to the fighting and disagreement in the region?” To which he responded: “That’s such an American question. What makes you think there’s any solution? This is a place where people have been fighting each other for 3,000 years. Maybe that’s just how it’s going to be.” I certainly hope that’s not the case, but the idea of finding a “solution” as being a distinctly American way of thinking was something I’d never thought about in that way before (I asked him if this view was broadly held he said it was, although he and many of his friends do hope that there’s some kind of path to peace).

I was also able to tour around Ramallah and the West Bank a bit and captured some photos from that part of my trip as well. Among the photos below is the “Stars and Bucks” coffee shop in Ramallah, the still under construction city of Rawabi – sometimes referred to as the “Palestinian Settlement” (it’s a full city being constructed for Palestinians in central West Bank; I had a chance to meet Bashar Masri who is a well known Palestinian entrepreneur and the main force behind the project). There’s also a picture below of the Entrepreneur Meet-up that we hosted in Ramallah one of the evenings of my visit. We had over 100 Palestinian entrepreneurs get together to talk about creating entrepreneurial communities and enhancing opportunities for Palestinian entrepreneurs. There’s also a picture of the “Startup Weekend Ramallah” sticker that I saw on many laptops around town – Ramallah has now hosted two such weekends.

The final story from my trip comes as I was leaving. The airport in TelAviv is famous for its security – I had to show my passport 3 times before I even got to the check-in counter. As part of this process every passenger goes through a triage process where they’re asked various questions about why you’re traveling, what they were doing in Israel, etc. Basically trying to suss out whether you’re likely to want to try to sneak a bomb onto your plane (based on this interview they then put you through various tracks of security ranging from pretty much what you’d experience in any US or European airport to hour+ interrogations accompanied by detailed bag and person searches). Upon taking a look at my passport the triage team in my case then spent the next 10 minutes quizzing me in a way that I can only summarize as “Exactly how Jewish are you?” I had provided them some information on the purpose of my visit (but no details on where I went or whom I met with) so that had at least a little context – you would think – to give them reason to ask about what I was doing there. But no – all the questions were centered on where I went to temple, how often I went, etc. Apparently I successfully convinced them that I was Jewish enough because after 10 minutes they let me through the light version of Israeli security.

A huge thank you to Saed and Yadin from Sadara for hosting me. And especially to all the great entrepreneurs I met with while I was there (especially George for the great meal in East Jerusalem and Yousef for our breakfast in Ramallah). It’s both humbling and exciting to be welcomed so warmly into this great community of entrepreneurs.

Betting for a cause this SuperBowl

I’m a big football fan and, despite not having grown up in Denver, have been a fan of the Broncos since I was little (my grandparents lived in Denver and my sister and I spent a month every summer here with them – my Grandmother’s passion for the Broncos rubbed off on me at a very early age).

I’m a big football fan and, despite not having grown up in Denver, have been a fan of the Broncos since I was little (my grandparents lived in Denver and my sister and I spent a month every summer here with them – my Grandmother’s passion for the Broncos rubbed off on me at a very early age).

So, of course I’m excited that they’re in the SuperBowl (again!). This has lead to the inevitable side bets with friends in Seattle. If the Broncos prevail I’ll be eating some fine Seattle smoked salmon while watching pictures of my friend Cory sporting the latest in Broncos paraphernalia (among a handful of personal spoils for their victory).

But my most important bet is with Dan Levitan of Maveron. We thought it would be fun to put some real money on the line. But to do so for a good cause. The bet is $5,000. If the Broncos win, Dan gives that amount to the Children’s Hospital Colorado. If the Seahawks win, I give the same to Seattle Children’s. Win win for sure.

We’re doing this to have fun. But also to raise awareness about the good work both hospitals are doing in each of our communities (and beyond). And hopefully raise some more money for them as well. If you’re so inspired, make a similar bet. Or just give directly to support these worthy causes (Seattle Children’s here and Children’s Hospital Colorado here).

Oh. And GO BRONCOS!!!

Act Like A Leader

Act like the leader. Simple advice but I see companies not do this all the time. You’re the leader in this space – act like it. Don’t be ashamed, bashful or defensive about it. This doesn’t mean beat the “we’re the biggest player in town” drumbeat all the time. It means leverage that fact and all that goes along with it to do things that the industry leader does – highlight customers, talk use cases, get more press, hold a user conference.

Act big. You define the game. You are the leader, you set the rules, you define how the game is played.

Don’t react. Smaller (ankle biters) can sometimes bate you into being reactive. Avoid this temptation. Stay above the fray, stay on course (that doesn’t mean be blind to what you’re learning in the market or what others are doing, but don’t fall into the trap of chasing your smaller competitors around).

Stay innovative. You want to keep your competitors scrambling to keep up. You’re already ahead in the market so you can do this effectively. But only if you keep innovating and pushing the industry. Don’t give anyone else the chance to catch up.

Leverage your leading position. This isn’t always possible, but if there are things that you can do from a product perspective that leverage the much larger data set and broader use cases you have access to do them.

Trada Update

Companies rarely grow in a straight line (or the fabled exponential one). Building a business isn’t about getting from point A to point D by passing through points B and C. There are fits and starts. Amazing discoveries and heart wrenching realizations. Huge highs and low lows.

Companies rarely grow in a straight line (or the fabled exponential one). Building a business isn’t about getting from point A to point D by passing through points B and C. There are fits and starts. Amazing discoveries and heart wrenching realizations. Huge highs and low lows.

Trada – which has built a large crowdsourced marketplace for search optimization – has been through its version of this crazy growth curve over the past 5 years. We’ve learned a ton and along the way have delighted a large number of customers. But we’re having one of those non-linear moments at the business and came to the realization that we needed to shrink to grow. So we took the harsh medicine and significantly cut back the Trada staff. The result was a business that has real revenue and customers, is growing and bringing on new business, is continuing to build and innovate product and is profitable.

I bring this up because it’s been falsely reported in a few media outlets (and on Twitter) that Trada is shutting down (purposely not linkning here – any reporter who can’t even perform the most basic due diligence on a story doesn’t deserve the extra traffic). Trada is not shutting down. The move the company made last Friday was bold, dramatic and painful. But it was the best thing for the business and its customers. This isn’t the first time we’ve seen a business retrench (Gnip, for example, cut back to 6 people a few years ago before profitably growing back to 80 and counting).

As I’ve said before, building a company is often a 10 year + journey. We have plenty of distance to go still at Trada.

SaaS Nomenclature

This has come up a few times so it seemed worth putting out there. It’s important to get a consistent set of terms when talking about your business. For example when you say sales do you mean booking or revenue? When you talk about revenue do you mean recurring or total? Is churn net of upsells or is an upsell a new sale? If bookings are the total contract value of everything you sold in a period, how do you normalize for different contract lengths? Are renewals counted in bookings or broken out separately? However you do it, just be sure to be both consistent and clear about what each term means.

This has come up a few times so it seemed worth putting out there. It’s important to get a consistent set of terms when talking about your business. For example when you say sales do you mean booking or revenue? When you talk about revenue do you mean recurring or total? Is churn net of upsells or is an upsell a new sale? If bookings are the total contract value of everything you sold in a period, how do you normalize for different contract lengths? Are renewals counted in bookings or broken out separately? However you do it, just be sure to be both consistent and clear about what each term means.

Below is something I’ve used for several of our recurring revenue businesses to make sure everyone was talking the same language:

MRR – current monthly recurring revenue (if we had one time revenue, number would exclude it; total revenue includes MRR and any one time or service revenue, etc.)

Bookings (or “Sales”) – the total contracted value sold in the period we’re discussing (so a month to month customer’s “bookings” contribution is 1 month revenue; a 2 year sign-up’s booking value – the full two years; basically it’s what we hit the credit cards for for our new customers)

New MRR – Also a bookings number but this normalizes for the monthly/annual/2 year booking but simply taking the one month value of all the customers sold in the period we’re talking about.

ARR – current monthly recurring revenue times 12

Churn – Monthly value of customers who didn’t renew. I don’t like netting this out of New MRR (as some do). Should be tracked separately.

MRR last month + New MRR – churn should equal next month’s MRR

Is the cost of starting a business less than zero?

There has been a well documented and discussed deep decline in the cost to start a technology business over the past ~ 15 years. From the days where every website was custom and each site element was a de novo build to today where virtual servers are easily and cheaply spun up and down and where frameworks exist for just about every feature and functionality that you could imagine building, the cost of starting a tech business has gone from $5-$10M to maybe $50k or less. It’s a remarkable trend and one of several key factors driving the Democratization of Entrepreneurship.

There has been a well documented and discussed deep decline in the cost to start a technology business over the past ~ 15 years. From the days where every website was custom and each site element was a de novo build to today where virtual servers are easily and cheaply spun up and down and where frameworks exist for just about every feature and functionality that you could imagine building, the cost of starting a tech business has gone from $5-$10M to maybe $50k or less. It’s a remarkable trend and one of several key factors driving the Democratization of Entrepreneurship.

But is it possible that the cost of starting a tech business has fallen to less than zero? In some cases I think this is now the case. It’s now possible for entrepreneurs to seed ideas into the market and get people to put their money where their mouths are before even laying down a line of code. And this trend is true perhaps even more powerfully on a product level from existing companies.

We recently announced our investment in LeadPages – a platform that allows publishers to quickly create and host lead and conversion pages. The company actually started by selling the product that it was thinking of building, rather than building it first. Co-founder Clay Collins put out the idea for the LeadPages product on his marketing blog and before they had even scoped the project had $40k of pre-orders (paid pre-orders). With that money he built the beginnings of what became LeadPages.

Also in the Foundry portfolio BetaBrand is doing the same thing on a product level through its ThinkTank initiative. The idea is pretty simple – customers “vote” on new product ideas by agreeing to buy them. The ideas that get enough support get made.

Browse Dragon, KickStarter or Indigogo and you’ll see lots of examples of this (not every crowdfunded project fits this but many do) – show your support for something and if we reach a certain threshold, we’ll create it for you.

Another great example of a company taking advantage of this trend is Filament. It’s ThinkTank for web apps. As they describe it: “We show you a vision of a Web app. Your votes determine whether we build it, and its features.” Exactly what I’m talking about.

I think this trend is incredibly powerful. And we’re just at the start of it. Just as we’ve seen the control of IT systems become decentralized across organizations of all sizes, I think we’ll also see a similar decentralization of the product ideation and development process. And while not every product and innovation can be developed in this way, many many can, should and will.

I’d love your thoughts on this as well as other examples of companies getting creative about pre-sales.

Getting our Angel List On

In the news/hype cycle of venture and start-ups it’s rare when a single news item captures the attention of the entire community, even for a few days, let alone 3 or 4. But AngelList‘s announcement of “Syndicates” has done just that. And it was pretty fun to watch the reactions which ranged from: “this is stupid” to “this will kill venture investing as we know it” to “this will change angel investing forever” to everything in between (see for example, AngelList Syndicates Will Also Pit Angel Against Angel, The Great Venture Capital Rotation, Leading vs. Following, Some Thoughts on the Big AngelList Deal, and Is @AngelList Syndicates Really Such a Big Deal?)

In the news/hype cycle of venture and start-ups it’s rare when a single news item captures the attention of the entire community, even for a few days, let alone 3 or 4. But AngelList‘s announcement of “Syndicates” has done just that. And it was pretty fun to watch the reactions which ranged from: “this is stupid” to “this will kill venture investing as we know it” to “this will change angel investing forever” to everything in between (see for example, AngelList Syndicates Will Also Pit Angel Against Angel, The Great Venture Capital Rotation, Leading vs. Following, Some Thoughts on the Big AngelList Deal, and Is @AngelList Syndicates Really Such a Big Deal?)

Of course none of these writers know exactly how Syndicates (which in short creates the ability for angels on AngelList to build funding groups around a specific company and take a portion of the upside associated with the success of the company/investment) will really work and neither do I.

But I do know that Syndicates is an interesting idea – and perhaps more importantly, yet another example of how Naval and AngelList continue to innovate around funding models for early stage companies. But I think what everyone is forgetting in this debate is that the radical innovation here isn’t AngelList Syndicates. It’s AngelList itself. The idea to democratize capital formation is the important idea here and a continuation of a key trend around start-ups and venture capital of the past 20 years. And despite it’s name, AngelList is really about the entrepreneurs who start businesses more than it is about the people who back them (although for those outside of the valley loop, AngelList is also democratizes the funding side of equation – both key parts of the overall Democratization of Entrepreneurship trend that we’re witnessing).

In many ways, Syndicates simply codifies (and specifies a value for) what’s already going on around fundings on AngelList where people get excited about an idea, commit to funding it, and then try to get others to jump in as well. In that sense it’s not really innovative so much as it’s encouraging activity that’s already taking place, making the rules around it more clear, and trying to get as many people as possible to join the effort (which is what Angel List itself is about).

Rather than debate the hypothetical, today Foundry Group decided that it would be more interesting to jump into the middle of the topic we’re all talking about. We’ve been thinking for quite some time about how to better leverage some of the angel activity that’s going on in our community (and through our investment in TechStars and through our own personal investments in companies and venture funds the four of us are already involved with over 1,000 early stage companies). The creation of Syndicates presents a great way to do this. So today Foundry is announcing the creation of FG Angels, through which we’ll invest in approximately 50 AngelList companies through the FG Angels Syndicate. We’ll put up the first $50k into the syndicate and will cap total participation in each of our syndicate groups at $500k (at least for now). There’s more detail on what we’re up to on our post about it from this morning.

More than anything, Foundry Group believes that we exist to serve entrepreneurs and to make them successful (and that doing so is the best way generate a great return on our investors’ money). AngelList Syndicates supports this idea and the formation of FG Angels is our effort both to be supportive to the AngelList community and to take advantage of a trend that – good or bad for VCs or angel investors – is part of a tidal wave of change sweeping over our industry.

The New Foundry Video Is Almost Here

You may have seen the video that Foundry Group produced a few years ago – a hard hitting glimpse into the life of a VC told in SNL style.

The video (and more importantly the song) was written and directed by my very talented partner Jason Mendelson. That’s his voice. That’s also his playing every instrument you hear on the track. Awesome

Well…we’ve been hard at work on another video (again written, produced and directed by Jason). This new one takes a look at some of the ways technology has changed our lives and asks the deep questions about whether we’re better off today or if things were simply better before all this gadgetry. It will be out in a few weeks. In the meantime check out the teaser to the new video below. You won’t be disappointed.