VCIR Blog

Some of you know that I’m chairing the annual Venture Capital in the Rockies conference this year (now called VCIR Winter). VCIR is put on annually by the Rocky Mountain Venture Capital Association and brings together a national group of venture capitalists for presentations by 22 rocky mountain companies that are currently seeking capital. This year’s conference will be held March 3rd through 5th up at the Hyatt in Beaver Creek (hey – we play to our strengths and the skiing up there is fantastic!).

Being the conference chair has been a pretty involving job (certainly more than I thought I was signing up for – especially in a down economy with sponsorship budgets tight) but also a very rewarding one. Among the things that I’ve changed around this year is the conference web site – www.vcirwinter.com. Along with a new look and feel there’s some new functionality – in particular the VCIR Blog. We’ll use the conference blog to not only put up announcements about the conference but also to give the presenting companies the chance to post about their businesses, have some long time attendees talk about their experiences at past conferences and, of course, to live-blog the conference itself.

I hope you’ll check it out and subscribe.

George Bush Sings!

How not to pitch your business

I had an exchange with an entrepreneur last night that I couldn’t resist posting (I did resist including the guy’s name, however). It started with a relatively typical email. One which I wonder why I still receive but still get regularly. The entrepreneur writes:

Seth…..I’d like to pitch you on a start up. I need the help of someone like you. I haven’t filed any patents yet and I need a nda signed. can we do it?

I respond as I do for all requests like this by saying:

Hi [name redacted]. Like most VCs I don’t sign NDAs (see: https://www.sethlevine.com/wp/2008/01/why-i-dont-sign-ndas). Let me know if you’d still like to show me what you’re up to (totally understand if you feel it’s too sensitive).

Here’s what I received in response:

Seth….I’m reaching out to you here, lets get off this old cookie cutter vc "don’t sign nda’s" attitude, it’s only until the patents are filed. I believe I’ve got one of the biggest deals to come down the pike in years. This isn’t my first rodeo. Just FYI, no matter how hard you crunch the numbers, this is a 20+B per year deal. I already have demo software and I need you to help me put a team together, the money will come as soon as we are able to "show and tell" so to speak. Please reconsider.

Really? That’s how you’re engaging with me? I can’t imagine how you think this is a winning strategy. Am I supposed to be bowled over by how amazing this potential opportunity might be, change a cardinal rule of our business and through this series of emails think that you’d be a competent manager, effective advocate for your business and a good guy to work with?

The initial email is completely casual, full of mixed cases and grammatical errors. Oh, and totally un-researched. But the second response really takes the cake and what caused me to post this for the world to see. Of course you have one of the biggest deals ever. Clearly this isn’t your first rodeo. Certainly you’re playing in a $20BN market. And without question I’m just one of those cookie cutter VCs. Obviously I should change my attitude.

[BTW, in case you were wondering, I didn’t bother responding]

How much does Google really know about you?

In case you were wondering what goods Google has on you check out http://www.google.com/ads/preferences/ from the browser you typically use for web browsing and search. If you scroll down you’ll see what interests Google has you pegged for and get to see the data they have collected on you in your cookie.

For me the most interesting part wasn’t the data they had on me, but looking through the Google interests taxonomy at the bottom of the page. There are specific tags for individual car brands, for your love of Bollywood movies, pest control, screensavers, etc. It’s an interesting glimpse into how Google thinks about the world (and more importantly into what categories Google thinks it can make money by trafficking).

What makes a great start-up market?

Here’s one take on that ubiquitous question (ubiquitous at least for those of us who live outside of the bay area). The simple answer is Nerds and Money, but the more complex answer is much more amusing.

This is a unique approach

I was sent the following a few days ago:

In order to give investors a sneak peak of what we’re up to, we’ve created a

short video (4 mins): http://www.youtube.com/watch?v=E9fiEu_TBdU

I appreciate the effort behind stuff like this (as well as the novel thinking).

While we’re on the topic, if there’s ever something you want me to take a look at, tag it to my del.icio.us account (for:slevine).

48 hours ago…

Just over 48 hours ago 72 people came together in Boulder Colorado to see if they could come up with a business idea and launch by midnight Sunday. We started Friday night with a handful of ideas . . . winnowed the list down to the top 3 favorites . . . and picked one to run with. Here’s the result:

The process of working on a business with 70 people in such a short period of time was amazing. I’ll put up some of the notes I took throughout the weekend in a post tomorrow but you can see a running tally of the experience at www.startupweekend.com. This was entrepreneurship on steroids and was as much about the social experiment of starting a business as it was about the idea itself (something lost on many of the comment authors on our TechCrunch posting, but not lost on anyone who actually participated).

Check out what we accomplished, but know that this is just the tip of the iceberg…

What’s a Fair 409A Discount?

Quick note: I’m not your lawyer. I’m not giving legal advice in this post.

Back in the olden days of venture capital, company boards had wide discretion in pricing company options. As is true today, there was a requirement that options be priced at or above the “fair market value” of the underlying stock (otherwise there would be tax consequences to the optionee and sometimes to the company as well). However the board could determine what that fair market value was and, generally speaking, there wasn’t a practical way that these valuations could be challenged. Most boards did some level of work to determine the FMV of a company’s stock but generally options were priced between 10% and 15% of a company’s then preferred price (because common equity sits behind preferred equity there is typically a discount applied to the FMV of common stock to account for this “overhang”). It was and is imprecise science but – at least in the case of venture backed startups – there wasn’t much harm in an option being priced low. It was a benefit to employees and a slight value transfer from equity holders to option holders (generally speaking in M&A transactions the value of the aggregate option exercise ends up allocated across the rest of the cap table). In a funny way it also benefitted the IRS in terms of tax collections as employees were taxed on the spread between the option and the value of the stock on exit and since these shares were typically exercised at the time of an exit were subject to short term capital gains. Higher strike prices distributes proceeds away from short term gain tax to equity holders who more typically are paying long term gains on the value that was shifted (I’m skipping a huge amount of nuance and detail here but the above is a general representation of how things work).

This all changed on January 1, 2005 when the IRS proposed new rules for the treatment of deferred compensation, including employee stock options (here’s the initial announcement; the code section was finalized in April 2007 – side note, there was a ridiculous interim period when the rules had been proposed but were incomplete and subject to final comment and approval; during that time companies were still expected to comply with the new rules, however the IRS conveniently only gave us until 12/31/05 – almost 18 months before the rules were finalized – to get it all right). Code Section 409A covered a lot of ground related to deferred compensation (and was generally thought to be the result of some of Enron’s business practices, although I think the IRS had in mind a number of different ways companies were structuring deferred comp arrangements that they felt underpriced the market and therefore resulted in immediate – but untaxed – gain to employees).

For startups it meant that for all practical purposes companies would have to hire an outside valuation firm to conduct a 3rd party, arm’s length analysis of the fair market value of a company’s common stock (boards were still free to make their own determination but doing so involved risks that effectively all professional investors determined were too great to take on). Over night a cottage industry was created to conduct these valuations. At the time, the cost of each of these valuations ran between $10,000 and $15,000 annually for each company. These costs have come down a lot since then, and the rules have been tweaked a bit but the overall 409A framework still is as it was when originally adopted – companies must hire a 3rd party to value their stock each year. These reports are generally quite lengthy and not always particularly comprehensible to non-finance professionals. So the rule of thumb is still to consider the FMV of common as a % of the preferred price – at least as a sanity check to the larger valuation exercise.

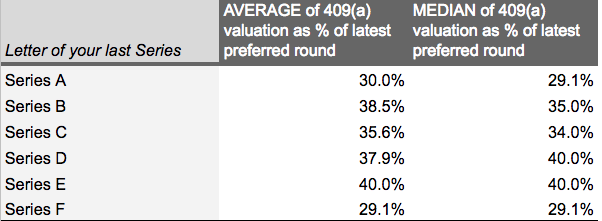

So what should this discount be? I thought it would be worth taking a look at the data across the Foundry portfolio. A number of factors go into the calculation and I assumed that the FMV of common as a % of preferred would vary both by company stage and by the time between the valuation and the last financing round. Specifically I assumed that the longer period of time between a financing and the valuation, the less the gap would be between preferred and common. Similarly I assumed that later stage companies would also show a smaller gap. I was wrong. From the data we collected, there was relatively little variance between company stage or time to last financing and 409A discount to common. There’s a little noise in a few spots in the data (due to small numbers of samples in certain categories) but the numbers were pretty concentrated around the average of 36% of the last preferred round no matter how you slice it. So 30%-40% is the range. Interesting…

Go Sox!

One of the things I’ve been thinking about as I’ve been sitting down to write is the balance I’d like in my blog. My intention was to write a professional blog, but with a personal twist –not a blog just about the mechanics

of being a VC, but my personal observations of the VC world and my growth as a venture capitalist. A few people have written in and reminded me not to forget about writing some posts about me with the idea that my VC observations will be more meaningful if I occasionally write posts that have nothing to do with being a VC, but give some background about how I got here and what else is important to me.

A high school friend of mine wrote to me the other day. He’s been reading my blog but was disappointed that I hadn’t posted on some important topics from our childhood:

“you gonna write anything about the red sox or patriots or just how to write financial models?” He asks.

Well, here you go, Dan. . .

I grew up just outside of Boston, so the events of the past few months have been pretty amazing to me. I always figured that the Red Sox would win the World Series sometime in my lifetime – I just wasn’t sure when. I was 14 in 1986 when the Sox came within a strike of winning it all. I actually didn’t see the famous Buckner gaff live. I had been babysitting down the street. The parents of the kids I was sitting for came home and we watched a little bit of the game together. When it was clear to me that the Sox were about to win I ran home (about 5 houses away) to enjoy the moment with my dad. When I got home my da locked solemn and told me that the Sox had blown it. I, of course, thought he was pulling my leg, so I called his bluff and ran into the family room to celebrate the victory. Long story short, that evening is one of the most vivid memories of my childhood (being a Red Sox fan is truly a scarring experience).

I’m going to give credit for the Rex Sox win this year to my 1 year old daughter (at least partial credit). In late summer my wife and I were in Boston for a wedding about an hour south of town. We spent a couple of days in the city to visit some friends and enjoy some time near where I grew up. My other best friend from high school (actually the twin brother of the author of the jab quoted above) is the sports director for one of the local Boston TV stations. He arranged one morning for me and my daughter to get access to the ballfield. I can assure you that it was absolutely a highlight of this life-long Red Sox fan’s life to walk into an empty Fenway Park with my daughter on my back (decked out in her infant sized Rex Sox ball-cap), walk down to the first row of seats and then onto the field. I had a camera to document the moment – picture of Sacha on the infield grass; me holding her in front of the green monster; her sitting on the visiting team bench (presumably putting a curse on them). Pretty amazing.

I’m, of course, convinced that her visit to the field brought good luck in the post season. At least that’s what I’m going to tell her . . .

Why blog?

Paul Kedrosky writes on his blog: Here is a puzzler: Why are there so many venture capital blogs? It is hard not to notice that there a host of such things out there, from Brad Feld’s to Fred Wilson’s, and everyone in between. Here are five possible hypotheses:

1. Professional service firms are highly branded by individual, so it makes sense to get out there and present yourself as a way of attracting deal flow.

2. There are just as many legal/financial/other blogs, but those people aren’t as good at getting media attention.

3. Venture capitalists don’t have enough to do.

4. Having a blog as a technology VC is a way of demonstrating your technical competencies.

5. Having a blog is a way to lay out your thought process about markets and technologies, thus demonstrating your added value as a putative investee board member. Let me add my 2c: 1 and 5 are generally on target – ultimately VC investing is about the people involved and the partner (or principal) you work with is more meaningful than the firm as a whole. 3 is off base – Brad is one of the busiest guys I know. My sense is that Fred is extremely busy as well and the two together are some of the most prolific VC bloggers around. I’m definitely not lacking for things to work on and as a result tend to write my blogs while traveling or in the evening. Perhaps 4 is a motivator tosome VCs, but really – how hard is it to set up a blog anyway? I can’t imagine anyone really feels that blogging adds much in the way of technical credibility. I have no clue on 2.

That said, here are some other possible reasons – at least from this VC blogger:

6. Writing things down requires more/better thought. The thought that goes into a post requires some time and attention. It’s easy to start to develop a “thesis” about something – to use a VC cliché that I’m not very fond of – but much harder to really understand something to the point of being able to organize your thoughts into a blog post.

7. Playing with the technology is interesting/helpful. This is different from 4 – I’m not talking about trying to prove to anyone that you are a technologist (I’m not one). I’m talking about getting your hands dirty and seeing what’s out there to get a better lay of the land (Mobius is an investor in Technorati, Newsgator and Feedburner, for example, so its directly relevant to my work).

8. Good VCs benefit from better educated entrepreneurs. Too much of venture capital seems like a black hole to many entrepreneurs. Perhaps this drives better deals for VCs, but ultimately an uneven playing field doesn’t really benefit anyone. Writing about how to give better VC pitches or what term sheet terms actually mean is a way of shedding light into the vortex and demystifying venture capital. Clearly, education is a theme across many of the VC blogs out there.

9. Creating a name. This is totally personal and perhaps only applicable to me, but it’s an important part of why I blog, so its worth mentioning. I imagine this is more true for the small number of non-partner VC bloggers like myself, but let’s face it – the VC world has a hierarchy and I’m trying to climb my way up it. Blogging is a way to give myself a voice that can perhaps be heard beyond my firm (The Wall St. Journal isn’t exactly beating down my door for quotes at the moment). I imagine this is a motivator for partner VC bloggers as well (although I don’t know that they would admit it as readily)

I’ve been meaning to post on this topic (might as well be transparent about what I’m trying to get out of this experience). Thanks Paul for the push to finally get this down on paper.

Also see Jeff Clavier’s response to Paul’s question here.