What the current markets are and are not telling us

In response to a comment to my post earlier this week about the Profit Imperative, I rattled off some ideas about the current state of the markets. I thought it was worth sharing as a full post (I’ve edited and expanded on the original comment).

There are clearly headwinds in the markets – I’m not at all suggesting that there aren’t. And we may be in a period of strong negative pricing pressure in both the public and private markets. As you know, markets tend to perpetuate themselves and pendulum. This cycle of overreacting is how business and market cycles seem to work. Without a doubt we’re in an environment of increasing volatility and that volatility alone may spook some investors. Price shifts at the top of the market, starting with the public markets and quickly spreading to the public market investors who had been dipping into the late stage private markets and continuing from there, will and are clearly changing pricing across all stages of private market financings.

I’m generally of the view that we’re not in a bubble (see my post on that from last September here). While there’s no functional definition of an asset “bubble” that people seem to agree on, let’s at least agree that they’re caused by a fundamental imbalance between the actual “value” of an asset and the way the markets are pricing that asset. We saw this clearly in the housing market when the access to cheap capital created run-away housing prices that weren’t sustainable by any historical measure of actual underlying value. We’ve certainly seen this in the public and private markets as well (for example in the 2000 crash where truly unsustainable levels of funding were driving too many bad ideas into the market and the perception of market value and future growth and profit potential was completely out of balance with reality).

I’d differentiate this from what we saw in 2008 in the private markets where prices contracted – in some cases relatively dramatically – but where there wasn’t a true bubble bursting in the way we saw in 2001. The private markets in that case were reacting to the larger trends in the public markets (the US consumer was in a painful process of shedding debt and readjusting their balance sheets after the housing bubble broke) and to a supply and demand change in the availability of capital. That so many great companies were started in this period perhaps suggests that the venture capital markets over reacted to what was taking place in the public markets (and that’s just one measure of the over-reaction).

When I look at the fundamental value of public comps, we’re already well below historical averages (and weren’t even at the top of those averages when the markets started correcting). When I see the drastic proclamations of arageddon I think they’re unjustified by the current actual market conditions. When I look at the US economic data I don’t see anything justifying the wide sell-off in the market. When I see companies announce 1-time tax hits and drop 40% of their value overnight, I see a market that’s overreacting.

There is clearly plenty of negative sentiment in the marketplace and this sentiment tends to be self fulfilling – we will see a contraction at Series A and (especially in my mind) at Series B. Capital will retreat, companies will have a harder time raising money and pricing will adjust (however to be clear, the rise of seed rounds in the past year is nothing like the overfunding of Series A and B that we saw in 99′ – and some might argue is good for the overall ecosystem as more ideas get enough legs to test whether they have merit and those that do go on to raise their A rounds). This is a bit of an oversimplification but to some extent we live in a bifurcated world. There’s a big difference in market behavior at the high end of the markets where there has been a “bubble” around so called unicorn companies who were chasing that billion dollar valuation. This led to aggressive valuations, to aggressive terms and to aggressive expectations on growth that I think are about to come home to roost in that market segment. But to be clear, I thought this long ago and well before the public markets started reacting.

Which all leads me back to my most important business mantra:

1) don’t panic

2) gather information

3) make informed decisions

As always, the order here matters a lot.

Track your favorite Olympic sports with Filtrbox

Information tracking company Filtrbox has put out a handy little widget for tracking TeamUSA at the Olympics. By choosing both sports (for example: "USA Cycling – Men’s Road") or an individual athletes ("USA Cycling – Men’s Road: Levi Leipheimer") you can keep up to date on your favorite Olympic stories.

Branding Colorado

Last week at the conclusion of the COIN Summit Colorado released an new brand for the state. The new branding effort was lead by Aaron Kennedy (of Noodles fame) with the help of a brand ‘committee’ (I was a member) and, importantly, a large network of ‘brand ambassadors’ around the state. The process was an interesting one and was designed by Aaron to be inclusive of opinions and ideas from around the state. The idea was to identify a unifying brand that could represent Colorado across a wide variety of uses (both inside the state and outside). The result is the image in the upper left of this post and the tag line “IT’S IN OUR NATURE”. The logo draws from the green on the Colorado license plate, using updated but similar mountain/peak imagery but also including CO and Colorado (I guess for the avoidance of doubt about what we’re talking about).

Last week at the conclusion of the COIN Summit Colorado released an new brand for the state. The new branding effort was lead by Aaron Kennedy (of Noodles fame) with the help of a brand ‘committee’ (I was a member) and, importantly, a large network of ‘brand ambassadors’ around the state. The process was an interesting one and was designed by Aaron to be inclusive of opinions and ideas from around the state. The idea was to identify a unifying brand that could represent Colorado across a wide variety of uses (both inside the state and outside). The result is the image in the upper left of this post and the tag line “IT’S IN OUR NATURE”. The logo draws from the green on the Colorado license plate, using updated but similar mountain/peak imagery but also including CO and Colorado (I guess for the avoidance of doubt about what we’re talking about).

I think it’s impossible to undertake an initiative such as this and find any kind of true consensus. And I suspect that people reading this will have mixed reactions to the new logo and branding. That’s kind of the nature of the beast. You should see the size of the three ring binder that I received as part of the Brand Counsel that reviewed all sorts of information from focus groups and brand brainstorms (now would be a good time to point out that the funding for this project was all private – the state didn’t pay for the fancy binders and formal letterhead, etc that I received). Personally, I like the new logo a lot and I think it was time for Colorado to update its image. I also like that the state will be consolidating around the use of this logo but also be allowing companies from Colorado to use the logo to tag themselves as Colorado proud (there are derivatives of the logo that signify that products were Made in Colorado or Designed in Colorado, etc.).

I can’t help but point out the similarities of both the logo and the tag line to the Colorado Entrepreneurial by Nature initiative that I helped start with a handful of other local entrepreneurs (and that was announced about a year ago) – if you’re a Colorado business and you haven’t signed up and badged your website you can do so here. I think the similarities speak to the broad view of Colorado as a place where business and nature mix (and reinforce each other). And I’m really happy that the work that our small group did around EBN was validated by the much broader work of BrandCO.

I can’t help but point out the similarities of both the logo and the tag line to the Colorado Entrepreneurial by Nature initiative that I helped start with a handful of other local entrepreneurs (and that was announced about a year ago) – if you’re a Colorado business and you haven’t signed up and badged your website you can do so here. I think the similarities speak to the broad view of Colorado as a place where business and nature mix (and reinforce each other). And I’m really happy that the work that our small group did around EBN was validated by the much broader work of BrandCO.

Look for both the EBN logo and the new BrandCO logo to proliferate.

Some thoughts on better board meetings

I sit through a lot of board meetings and while they are a great time for a company to harness the expertise of the people sitting around the table, they need to be structured and managed in such a way to actually accomplish that (i.e., effective board meetings don’t just happen – they are the result of planning and careful management). I sometimes joke with my dad that it must be tuff to get a word in at his board meetings given the powerhouses around the table; he just laughs and tells me that they prepare for their board meetings carefully. In actuality, I think he get a huge benefit out of his board – as do many of the companies I’m involved with – by doing exactly that. Here are a couple of quick thoughts on what that kind of planning and preparation might look like. Send out the board package in advance (a week is great; minimum is a couple of days). This allows you to set up an expectation with your board that they will have all read your board package carefully (which they should do, but won’t always be possible if they get the board package at midnight the night before the meeting). The board package should be comprehensive and cover updates from each department. Include a CEO letter or overview at the beginning of the package. This gives you the chance to set the tone for the meeting – setting up topics that you plan to dig into deeper and asking people to think about certain areas of the business for further discussion at the meeting. Since the board package is also probably pretty thick and full of data this gives you the chance to set the lay of the land for the board (very helpful) and point out specific things that you’d like to highlight in the package. Do not review the entire board package at the meeting. If you are sending out your board package in advance of the meeting and the package is comprehensive by department you should not feel the need to review the entire package (since everyone will have read it). Pick the highlights you want to cover; point out specific items that you’d like to bring the board’s attention to (presumably you’ve done this in your CEO letter as well); ask if there are any questions about the material. But please – don’t spend hours at board meetings reading every page of the package; if you work up a separate presentation to guide the board meeting itself, don’t feel like you need to stop on every page. Many of our companies like to focus on one strategic area of the business at each meeting and prepare a separate presentation to guide that discussion. I think this is a great idea. Make the presentation no more than ½ hour and be sure to make it strategic rather than tactical in nature.

Ask for help. Tell your board what you’d like from them. Be specific about ways they can help. If you need help with contacts be specific about who (or what titles) you are looking to meet (i.e., “we need contacts at potential customers” is not helpful – “we’re looking for a senior contact at xyz company for the following reason; I’ll send out a summary of where we are and what we’re looking for” is). If you are asking the board to vote on something, put all of the votes together and provide the right level of detail to make decisions. Putting all of your board ‘business’ into one section of the meeting helps streamline board meetings, as does including the appropriate level of information (for instance, if you are asking for approval for stock option grants be sure to include the % of the company people are receiving, the proposed vesting schedule and highlight anyone who is out of the bands the board has already approved; you should also include the total number of options in the pool and the total number remaining after the issuance you are asking for). If you’ve done extensive research on a topic and have a recommendation, put a summary of the issue and the recommendation on the same slide (and put the recommendation on paper – I find that when companies don’t do this, the discussion tends to ramble and isn’t focused on all the work that has already gone into researching the problem). Include your management team. I don’t like when companies shuttle management into and out of meetings – it’s disruptive and frankly I think that management teams should participate in the operations update for all departments – not just theirs. To do this effectively, start your board meetings with your operations updates and cover all topics that are appropriate for management to be included in, then ask them to leave to cover other board business, option issuance, etc. Don’t introduce new info at the board meeting. It’s much harder to react to surprises on the fly. You should include data in the board package or preface a topic you’d like to cover in your CEO letter (and if you can’t do either of those for some reason, give each board member a heads up before about a topic that you’d like to cover or about a piece of news that wasn’t included in the board package. Every board meeting should have an executive session of the non-management board members. This is a time for the investor and outside board members to talk about their impressions of the business and react to the board meeting. Do this every time – even if there is nothing to talk about (so that when there is something to cover it won’t be awkward). To use this effectively, make sure your board has a specific plan for communicating back to you from this meeting (i.e., have a standing meeting with the board chairman; ask the board to appoint someone on a rotating basis to debrief, etc.) – you shouldn’t be left in the dark about this section of the meeting and they should be used to gather feedback from the board (who probably never talks as a group outside of this session of the board).

Brad had a nice post on the subject of board meetings here. There are others floating around the blogsphere as well (if you do a Technorati search, you’ll find a bunch of them).

Hope that’s helpful. Comments/thoughts are welcome.

Toys

Here’s some stuff I’ve been playing with that I’ve been meaning to post about: First is MyBlogLog, which tracks links people follow from my blog site. It also tells me how many page views were served from my site. Since I serve full feeds this doesn’t capture all of my link traffic (I miss everything that isn’t clicked directly from the site itself), but I get enough direct site hits to extrapolate these data to my subscriber base. If you want you can also put up a chicklet on your site that shows your most popular links. It’s easy to set up (you have to embed a small amount of code on your site) and intuitive to use. Some more flexible reporting and perhaps different UI for reports would be helpful, but I’m sure Eric is working on those. If you blog and you care about user stats (what am I saying – all bloggers care about their user stats!) this is a great tool to have. I’ve written a few posts (here and here and here) that reference better ways to view information. While the UI of TagCloud is pretty lacking its still a HUGE step in the direction I’m talking about. You can point a bunch of blogs to this tool and it will pick out the overlapping words. Yah – this needs a NLP engine to really be useful and pull out full concepts rather than single words. Still it’s a great idea. Now they just need to make it look more like this. (thanks to Walker for pointing me to this site)

Last is Smartfeed which unfortunately I can’t play with directly because I’m lame (of course you already know that) and have an old, monochromatic, can hold phone numbers and play some stupid ‘snake’ game but not much else, phone. I met Kevin Cawley who wrote it, however (he lives in Boulder and he let me play with it on his phone). It’s an interface for downloading podcasts onto Windows Mobile Edition powered cell phones. I’m starting to get more on the podcasting bandwagon (at least for some things – by the way, Newsgator released a podcasting client that rocks and that I’m now using as my main podcatcher) and as soon as I upgrade my phone I’m all over it.

Any other cool stuff out there?

23 days until Glue

As you can see from the date of my last post, I’ve been a bit tied up. Not to worry – new content coming soon. Including some more thoughts leading up to our Glue conference. In the meantime here’s a repost of some thoughts from Eric Norlin as we near 3 weeks out from Glue.

Yes, we are “rounding the bend” — 23 days until Gluecon. I feel like I’ve droned on endlessly about how great it’s going to be (I probably have), so let me just take a different approach by highlighting some things I’m looking forward to — starting at the END of Day 2 and working backwards a bit.

David Linthicum’s closing keynote: I’ve never met David, but he has the reputation of being super smart — having been around SOA architecture stuff, and now cloud stuff for quite some time. David told me he’s more comfortable speaking to a technical crowd, and I said, “perfect.” I’m looking forward to his thoughts where we go from here.

The ”Hacking Identity” track – which highlights user managed access (Eve Maler), federated provisioning (Nishant Kaushik), XAuth (Chris Messina), and Webfinger (Brad Fitzpatrick) and follows it up with a discussion moderated by Ian Glazer (of Burton Group, now Gartner).

“Integrating Drizzle” with Eric Day from Rackspace. Rackspace brought most of the Drizzle guys on board when the Sun-Oracle merger happened. I’m anxious to learn more.

“On Hadoop” with Todd Lipcon from Cloudera. Hadoop is about as dominant as it gets at the moment, and I profess to knowing far less about it than I should. You?

Three sessions on scalability and the cloud stack — from Bradford Stephens (Hadoop, HBase, Zookeeper), Oren Teich (of Heroku, on scaling apps), and Sebastian Stadil (Scalr).

That’s just one possible “track” of sessions that runs from Lunch to the end of Day 2. That’s an extra-large helping of information. In one afternoon. And you can make your own choices.

I’m really proud of what we’ve got going, and when I look around at what else is out there – be it 1 day unconferences (that cost the same as gluecon), or large tradeshows (that cost 2-3x gluecon), and exceedingly happy about the value that we’re offering developers. So, get your butt to Gluecon!

Are you the master of your domain?

The title of this post is meant to be taken literally, not metaphorically. Do you control your domain?

Last Friday one of our portfolio companies briefly lost control of its domain. It wasn’t the fist time we’ve seen this happen and, as you can imagine, the result could have been disastrous (in this case we were able to lock down the domain before anything nefarious happened, but people don’t steal control of your domain for anything other than doing bad things, so it was lucky that we were able to avoid a serious issue). Different registrars have different rules for transferring domains around. In this case all it apparently took was someone writing the registrar and claiming the domain was in fact theirs. We believe (but aren’t positive) that the registrar did send an email to the contact listed in our account stating that the domain was to be transferred unless action was taken by us (that the process is that simple is a matter for another post altogether). But this email either didn’t get to us or was not acted upon promptly enough to prevent the transfer. The company then jumped through hoops for several hours to get the domain first locked down (so the party who stole it from us couldn’t redirect it) and ultimately transferred back.

Last Friday one of our portfolio companies briefly lost control of its domain. It wasn’t the fist time we’ve seen this happen and, as you can imagine, the result could have been disastrous (in this case we were able to lock down the domain before anything nefarious happened, but people don’t steal control of your domain for anything other than doing bad things, so it was lucky that we were able to avoid a serious issue). Different registrars have different rules for transferring domains around. In this case all it apparently took was someone writing the registrar and claiming the domain was in fact theirs. We believe (but aren’t positive) that the registrar did send an email to the contact listed in our account stating that the domain was to be transferred unless action was taken by us (that the process is that simple is a matter for another post altogether). But this email either didn’t get to us or was not acted upon promptly enough to prevent the transfer. The company then jumped through hoops for several hours to get the domain first locked down (so the party who stole it from us couldn’t redirect it) and ultimately transferred back.

We rarely (really never) talk about domain security when we’re talking about other security measures that companies take to lock down their data, transact securely, etc. But clearly it’s extremely important to make sure that you have (and always maintain) control over your domain. This starts with making sure your domain is a corporate asset – meaning that it’s not in the account of a founder but in an account that is owned and controlled by the company itself. It’s also extremely important to make sure the contact information in this account is up to date. And that you pay attention to any notices that your registrar might send you (in a timely mannor).

So seriously. Make sure you are the master of your domain.

Zero. Zip. Nada.

The US personal savings rate fell to zero in June – its lowest level since the latest spending binge started (post 9/11) and the 2nd lowest since the Great Depression. You can read the full government report here (be sure to check out some of the tables – very interesting information). Yes, the economy grew at a healthy annualized rate and clearly the Fed is still worried about inflationary pressure (we still have 50-100 basis points left to move in the fed funds rate) . But still – personal savings rate of 0%? We already lag behind the rest of the world in our ability not to spend pretty much all of what we earn (see here for a chart of US savings rates by quarter for the past 5 years) , and this trend shows no sign of improving.

I don’t get why these sorts of data don’t get more press. It seems that yesterday’s announcement received little, if any, attention at all. But our inability to save is a serious problem. Combined with deficit spending and our trade imbalance we’re increasingly reliant on outside capital to finance our collective lifestyle. Ultimately these trends are not sustainable.

I don’t get why so few people seem to care . . .

Data, Data and more Data

I had planned to title this post “If you have a data intensive business, don’t forget to look at your data.” But when I thought about, really all businesses are (or should be) data-intensive. And as a result all businesses should be obsessed with the data their systems generate. Measure. Track. Analyze. Adjust.

Years ago I remember sitting in ServiceMagic board meetings when Rodney or Mike (the co-founders) would pull out a Blackberry and announce: “in the 45 minutes since this meeting began, we’ve made 62,135 dollars and 37 cents!” They were obsessed with their system data and they had designed their platform from the very start to allow them to pull out any and all data they wanted. They had access not just to revenue data, but to leads, customer contacts, call center calls, sales funnel changes, site visitors, marketing spend, etc – really anything that had an impact on their company. As a quant-geek myself, I really appreciated what went into the design of their systems that would allow them to surface these operating metrics so easily (not to mention the mindset of Rodney and Mike to insist that they had access to this information at all times).

Fast forward to today and many of our companies have a similar attitude towards the data that drive their business. From the daily digests that report progress on key metrics, to obsessively watching data to look for early warning signs of system problems that their operations alerting hasn’t caught, to posting key operating and engineering data in the lobby of the office, these companies realize that the patterns revealed in the data around their companies will help make them more successful. Several of our particularly data intensive businesses have hired business analysts whose entire job function is to comb through databases and pull out interesting stats and trends. In one of my favorite examples, one of our portfolio companies includes not just business metrics on their lobby data-monitor but also tracks the latest engineering build and bug list. In another of our companies weekly meetings they’ve instituted a “data first” policy, where each department lead reports on their key metrics (against the plan for that week). There’s plenty of time to talk about the meaning behind the data, but by reporting the metrics first the company 1) reinforces it’s data-driven culture and 2) gets the entire company on the same page about what they are tracking and how they’re doing.

Love your data. They’ll love you back!

IPO or M&A? Here’s exactly how large companies exit

I wrote a post a few months ago based on some data from Correlation Ventures about the distribution of returns on venture deals (which revealed that outsized winners are, in fact, much more rare than most people think).

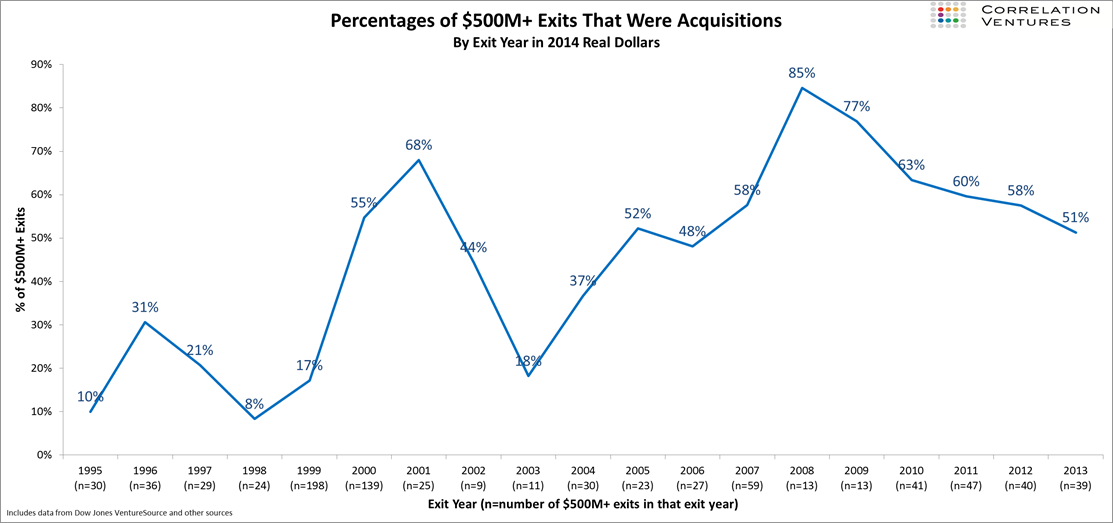

Today I’m focusing on companies in those top return categories with some new data from Correlation that show the percentage of large exits (>$500M) that are generated through M&A vs. IPO (quick side note: I seriously love how much information Correlation collects and how free they are in letting me post about it – as a reminder, Correlation is a firm that co-invests based on an algorithm that predicts the success of the a company; we’re in a few deals together and I can tell you the process is quick and painless; end of advertisement, but seriously – these data are from their work and the fact that they’re so interesting shows why the model works for them).

The graph below shows the trend of exits – IPO vs. M&A over the past handful of years (side note here that Foundry, like many firms, considers an IPO a financing event, not an exit in and of itself; although obviously it can be a path to an exit shortly thereafter).

A few key take-aways here:

– Acquisitions represent about half of all large exits in recent years, showing that both are – at the moment – reasonable paths to exit.

– There’s quite a bit of variability year to year (and cyclicality – not surprisingly), but the overall trend has been to more larger acquisitions (at least relative to IPOs). This reached it peak in 2008, although that may in large part be due to the lack of a public market option at that time.

– Generally speaking this trend holds true regardless of the absolute number of large exits in a given year (this is from the underlying data – not the graph, obviously).

I find data like these fascinating. Humans are horrible at proper attribution (a subject for another post) and I think this is particularly true in a hype driven industry such as venture/entrepreneurship. We all latch on to the big stories and the outlier returns – likely why so many people wrote me after my post on the distribution of venture exits and why there was so much interest on Twitter about it – the data didn’t match the heuristic people had in their heads. For me at least the same is true here – I would have expected the percentage of large exits from M&A to be significantly higher than exits through IPOs.

And that, of course, is why it’s important to actually look at the numbers rather than guess.