How to value your SaaS company

If you read my blog regularly you know I love (LOVE) metrics.

So no surprise that when River Cities Capital released an overview of SaaS operating and valuation benchmarks, I hung on every juicy detail. It’s chocked full of them – I’d highly recommend your reading the full report. But if you’re too busy for that, below are some of the key take-aways. I’ve added color commentary of my own that’s more relevant to earlier stage companies as well.

The methodology here was great. They took the 92 public SaaS companies and analyzed their key operating metrics. Beyond that, they actually went back in time and looked at the earlier stage periods for these companies so we can track how some of the world’s best SaaS companies performed at revenue levels more akin to a typical Series B business.

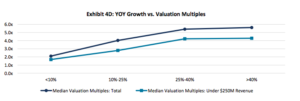

The “Rule of 40” is important. The rule of 40 is a benchmark that adds growth rate and EBIDA together. The idea is that if the addition of these two numbers is greater than 40% your business is on track. The valuation metrics show this clearly. Companies in the study that scored 40% of greater had TTM revenue multiples of 6.4x on average. Companies that scored between 20% and 40%, 5.3x, 0%-20% 3.8x and below 0% 1.9x. Healthy SaaS companies balance growth and profitability.

At IPO only 7 of 39 companies that have gone publics since 2013 had positive EBITDA. More on this below, but growth is more important than profitability, subject to the balance in the rule of 40 note above.

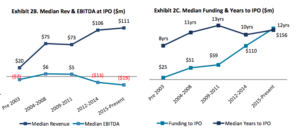

There are a ton of private SaaS financings. In 2016 there were over 2,000 financing rounds of private SaaS companies ($18.5Bn invested). Over 2,000 different firms participated in these rounds. This has contributed to companies raising more money than in the past before they go public (almost $100M on average for SaaS businesses that went public after 2011 vs. less than half that for those that went public before). It’s not clear from the study how much of this increase is going to shareholder liquidity, but clearly that’s driving some of this difference. Note in the graphic below the next point how this number has been increasing over time.

The average SaaS company is now 12 years old and has over $100M in revenue at the time of their IPO . See the graphs below.

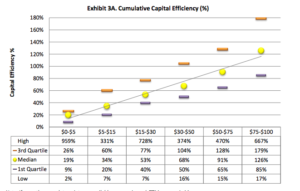

Capital efficiency was not as good as I was expecting. The River Cities study measured the ratio of revenue to money raised. Not surprisingly companies raised well above their revenue level in the earlier stages as they built product and sales and marketing. The curve goes up for sure, but was lower (i.e., had a lower slope) than I expected. But note the increasing divergence between higher performing companies (3rd quartile and better) vs average. The better companies more quickly become capital efficient (in the $30-$50M revenue range) vs. their average peers.

Interestingly growth and capital efficiency stats are down. Companies who went public after 2011 are less efficient with their capital and growing more slowly than their pre-2011 IPO peers. I imagine this is in part due to secondary liquidity (driving presumably by larger funds driving larger check sized into pre-IPO companies) – this counts as money invested in the capital efficiency score but in actuality doesn’t reflect money used to grow the business. This also may reflect the overall crowding of the marketplace and increased competition these businesses are facing.

Growth still matters. I’ve written about the growth imperative before (and it’s counterpart the profit imperative). While not quite as crazy as it was in the fall of 205 when I wrote that first post, growth still matters. The chart below illustrates this. Interestingly at the time of IPO growth above 40% doesn’t move the needle (I’ve heard this from bankers as well before seeing these data). Top performing SaaS businesses grow quite quickly. The average public SaaS business took 6 years to go from $5M TTM revenue to over $100M (but worth noting that Concur, Ultimate Software and Vocus each took 11 years to do the same and ultimately became quite successful). Page 17 of the report digs into some additional data that felt too detailed for this summary but is worth looking at relative to the nuance of these growth rates from various revenue starting points.

Not surprisingly churn matters. Ultimately churn is a drag on growth and on sales efficiency. Good SaaS businesses retain > 85% of their customers and have close to 100% revenue renewal rates when including upsell. You’ve probably heard this from your investors before, but there’s a reason for that.

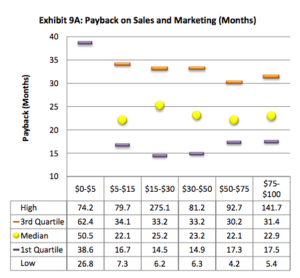

Sales efficiency was not as good as I expected it to be. I generally prefer CAC payback (vs LTV to CAC ratio) – especially for earlier stage businesses. And as a rule of thumb for businesses in our portfolio we target payback periods of 12 months or less. The study actually showed that these payback periods were longer than I would have expected with medians across company size closer to 24 months than to 12 (note in the graph below the meaning of quartile is flipped from the efficiency graph above). I have an upcoming post about this but a company’s ability to invest in longer payback periods relates closely to both the capital on its balance sheet and it’s access to additional capital.

Verticalization. There are some interesting notes in the report about greater efficiency for vertically focused SaaS businesses which I initially found counter intuitive and are worth considering in the context of your own SaaS business. Overall the SaaS market is becoming more vertically focused as, I think, a natural reaction to specialization in the industry (not to mention crowding in the marketplace as companies seek more specific niches for their products).

Hopefully the benchmarks I summarized here will be helpful to you as you think about your own business’ trajectory relative to your peers. Again, I’d urge you to read the full report as River Cities did a really nice job of analyzing a large data set and presenting the information in an easily digestible format.

Quova and geo-location in the news.

I’ve written a couple of posts in the past 2 months on the power of location (read them here and here). Quova – the leading player in the geo-location space – has had a couple of articles published about them in the past week that I wanted to pass along. I particularly like the article about how MLB is using the technology (not because it describes the origin of the Quova name – which I’m embarrassed to say that I never knew – but because it speaks to ways that companies are using geo-location information to create new and significant sources of revenue).

Baseline – Major League Baseball Struggles to Reach Fans Online

Bank Director – Keeping Online Banking Safe: Why Banks Need Geolocation and Other New Techniques Right Now

The company has also announced a bunch of partnerships this year – including four in the past three weeks (you can find links to them in the Quova press room here). The partnerships range from Corillian (to prevent banking fraud) to 41st Parameter (for more general internet fraud) to NextLinx (for global trading compliance/patriot act compliance,etc.). They highlight the point I was making in my prior posts on geo-location about why companies should care about where their web-site visitors are coming from. I think it’s clear that we’re going to see more and more companies and industries adopting the technology.

Foundry Group Joins the Entrepreneurs Foundation of Colorado

Foundry is pleased to announce that we’ve joined the Entrepreneurs Foundation of Colorado. EFFCO was created to encourage philanthropy from entrepreneurial companies in Colorado (there are chapters in many other major markets across the country). By encouraging companies to donate a small percentage of their stock (in the form of a warrant that is only exercisable when the company is sold or goes public) EFFCO is both raising funds for local non-profits as well as encouraging companies to foster a culture of philanthropy early on in the life of their company.

We’re strong supporters of the mission of EFFCO (in fact Brad was among the founding members of the CO chapter) and are happy to announce that we’ve donated 1% of our carried interest (the equivalent of 1% of our equity) to the Community Trust Endowed Fund of the Community Foundation Serving Boulder County through EFFCO.

I’d be happy to give you some more information if you’re interested in having your company become a member of EFFCO (email me directly).

We’ve helped over 150 small businesses navigate the crisis | Here’s what we’ve learned

I wrote recently about the The Finance Assistance Network (FAN), that I helped set up (along with Lew Visscher and Phil Votteiro) three weeks ago to offer pro bono financial advice to small businesses affected by COVID-19. So far the network has helped almost 200 companies navigate questions around surviving in the post-Covid work and to access PPP and other federal assistance. Tomorrow (Friday, May 1) at 9:00MT the FAN is hosting a webinar – Extending Your Runway: Small Business Tools to Survive a Cash Flow Crisis. The webinar is hosted by Good Business Colorado and is sponsored by a number of organizations advocating for small businesses including MAPR Agency, The Bell Policy Center, Small Business Majority, and others. The webinar is free and you can register here. I’m encouraging everyone to share the information about the webinar and the FAN on their social media channels and especially with small business owners in their networks. Supporting small businesses during this crisis is crucial to the overall health of our economy so please spread the word about these free resources.

I wrote recently about the The Finance Assistance Network (FAN), that I helped set up (along with Lew Visscher and Phil Votteiro) three weeks ago to offer pro bono financial advice to small businesses affected by COVID-19. So far the network has helped almost 200 companies navigate questions around surviving in the post-Covid work and to access PPP and other federal assistance. Tomorrow (Friday, May 1) at 9:00MT the FAN is hosting a webinar – Extending Your Runway: Small Business Tools to Survive a Cash Flow Crisis. The webinar is hosted by Good Business Colorado and is sponsored by a number of organizations advocating for small businesses including MAPR Agency, The Bell Policy Center, Small Business Majority, and others. The webinar is free and you can register here. I’m encouraging everyone to share the information about the webinar and the FAN on their social media channels and especially with small business owners in their networks. Supporting small businesses during this crisis is crucial to the overall health of our economy so please spread the word about these free resources.Early Monday morning, the Small Business Administration’s application system for its second round of PPP funding crashed within an hour of coming online. The first round of $342 billion — nearly ten times what the SBA administers in a typical year — was depleted in just 13 days. And like the first round, this latest infusion of $310 billion will be delivered on a first-come, first-serve basis.

Getting money into the hands of small businesses is a good idea, and we applaud the government’s quick actions. However, in the haste to create and pass these two rounds of emergency financial support, there are some gaping holes that must be addressed quickly so companies can make the most of these lifelines and extend their financial runways.

According to data released by the SBA, the average PPP amount was just over $200,000. That equates to a nearly $100,000 monthly payroll — hardly “main street” businesses. For companies reliant on PPP funding as a lifeline for operational survival, the stakes for accessing and using this funding wisely could not be more high.

How high? A just-released survey from Goldman Sachs finds that nearly 70% of small businesses will likely change their business models for good as a result of COVID. In other words, if companies are relying on the same strategies that they had in place in January to keep their doors open, the ability to adapt and update practices now has an even greater urgency. Even in good times, most small businesses carried between one to three months of cash reserves. More than ever, understanding and then extending financial runways for small businesses is a critical component to helping businesses survive.

A little less than three weeks ago, we helped create the Finance Assistance Network, a pro bono alliance of senior financial professionals, supported by legal, HR and other resources that are available for free to any small business or nonprofit organization impacted by COVID, regardless of size or location. The network connects business owners with a small army of CFOs, controllers and senior financial professionals willing to help with business and cash flow planning, applying for PPP and EIDL money and urgently needed support.

Since launching earlier this month, the network has helped more than 150 companies, giving us unique insights into the special challenges and limitations of the CARES Act. For example, the companies we’ve helped appear to be especially impacted by the eligibility criteria for PPP funding because the programs exclude many small businesses that can benefit the most from this support.

Many small businesses rely on consultants and part-time 1099 workers who do not appear on payroll calculations (they can apply as individuals to the program, although anecdotal evidence is that few are), which can hurt their chances for larger loans. Likewise, businesses owned by women and people of color are at special risk of being excluded from PPP funding because they are more likely to make use of contractors and less likely to have established relationships with SBA approved banks.

The feedback that we hear most frequently is that the calculations of payroll are far too small to provide the stabilization needed for ongoing survival and continued operations. Many small businesses have expenses, such as rent and utilities, that are significant relative to their payroll costs. By stipulating that funds need to be spent on payroll to qualify for forgiveness and by covering only an 8-week period, the current program effectively acts as federal unemployment insurance, rather than a business stabilization program.

Our biggest takeaway is that companies need more flexibility in how they spend aid dollars to balance what’s in the best long-term interest of their business and in the best interests of their employees. Many employees will likely be out of work well past the 8-week period anticipated by Congress, and some are better off individually taking enhanced unemployment benefits.

This Friday, we are partnering with Good Business Colorado to put on a free webinar, open to all, to share how companies of all sizes should be thinking about approaching business planning through the crisis. We’ll also discuss how they can access the pro bono resources provided by the Finance Assistance Network, apply for PPP and other loans and get expert guidance on using these funds to help your company extend your financial runway. Please join us by registering at https://bit.ly/3bM3OPg.

Seth Levine is a partner at the Foundry Group. Lew Visscher is the founder of Lew’s List. Phil Vottiero is a partner at High Plains Advisors. Together, they are the founders of the Finance Assistance Network, a pro bono network of more than 100 senior finance professionals who have come together to help businesses navigate and survive the COVID-19 crisis.

Boulder needs to VOTE NO on 300 and 301

Below is from a post we just put up on the Foundry blog. It’s critical in this election that the business community in Boulder takes a stand for progress and against closing the doors to the city. The two issues below are of great importance to the city of Boulder. So is electing a strong and reasoned City Council. I’m supportive of OpenBoulder’s approach to that and they have great information on the candidates they’re backing. In particular I’ve been helping my friend Bill Rigler with his campaign and would encourage you to be sure to include him as you vote. He’s a thoughtful, progressive leader who will bring great energy and mindfulness to our city.

This year’s local election in Boulder is a critical one. The city that we love risks shutting its doors. While the business community in Boulder has contributed immeasurably to the vibrancy, charitable contribution base, economic development, and success of our community, there is a faction in Boulder that feels that our city should stop moving forward and instead should live in the past. This faction believes in a less inclusive Boulder and aims to achieve this goal by literally shutting the doors to our city.

This is what is behind propositions 300 and 301 which are proposed amendments to the city’s charter.

This faction is well organized and well funded and the slogans make it sound reasonable. But make no mistake: the goal is to immediately freeze all development of all types around the city by enveloping the city a bundle of political red tape.

In the coming days, Boulder residents will be asked to vote on the following:

#300 – Neighborhood Right to Vote on Land Use Regulation

#301 – New Development Shall Pay Its Own Way

These initiatives must be voted down.

While innocuous sounding, the names of these initiatives completely misrepresent their intent and the dire consequences that would result if they are enacted. The truth is that neighborhoods already do have a say in projects that affect them, and developers already do pay some of the highest fees and taxes in the country.

Effectively, these proposals will create 60+ neighborhoods in Boulder. Can you imagine what would happen if we had that many homeowner associations that had the power to hold special elections and veto land use changes approved by city council? The smallest of those neighborhoods would be comprised of just 19 houses. That’s not “local control” (which already exists), that’s a deliberate attempt to create gridlock.

These initiatives will immediately freeze important infill development, including affordable housing, transit-oriented development, neighborhood serving retail, social service centers, and day care centers. The city manager has stated that the city will stop issuing permits of any kind for at least six months while they figure out what these initiatives mean and how to implement them. Once they do start reissuing permits, these initiatives will force the city to levy such high taxes and fees that development will effectively stop in Boulder. This will stop our city in its tracks and greatly exacerbate an already expensive housing market.

These measures are opposed by six former mayors, all nine City Council members, numerous former city council members, Boulder Housing Partners, The Daily Camera, and numerous civic groups like Open Boulder, the Boulder Chamber, Better Boulder, and others. Open Boulder executive director Andy Schultheiss has called them “among the worst pieces of public policy I’ve seen in almost 25 years of observing and participating in local policy-making.”

It’s critically important that we defeat these measures. To do that we need to get the word out to those in our community who want Boulder to continue to be a vibrant city. The sad irony is that those promoting these measures have the time and organization to put towards pressing their backward and closed agenda while many who oppose it are busy helping keep Boulder prosperous by creating jobs and economic growth.

This is a battle we can’t afford to lose. Please take a minute to help us get the word out. Send it to your friends via email and social media. Urge your neighbors to vote and make sure you vote yourself. With ballots mailed out this week many in our community will be voting in the next seven days (over 50% of ballots are returned within a week of their being sent out).

#keepboulderopen

Seth, Jason, Brad, Ryan

_______

Below are some suggested tweets or Facebook posts should you chose to share them:

Click to Tweet: i agree with @foundrygroup. 300 and 301 will have devastating effects on boulder. VOTE NO on both! #keepboulderopen http://bit.ly/1RdPv4K

Click to Tweet: i stand for keeping the doors to boulder open. VOTE NO on 300 and 301. #keepboulderopen http://bit.ly/1RdPv4K

Click to Tweet: in boulder’s upcoming election we’ll decide if we want to live in the past or continue to thrive. #keepboulderopen http://bit.ly/1RdPv4K

Designing the Ideal Board Meeting – Board Conflict

Life without email?

For most technology professionals (really most professionals of any kind) email is so integrated into our work that we can hardly imagine life without it. Sure, it can be a distraction at times and – especially if you carry a wireless device – hard to escape from. But it also greatly enhances productivity, allows us to communicate quickly and effectively and to have asynchronous interactions with a great number of people. I know in my own work life I send and receive between 200 and 300 emails a day. And since I’m already tied up on the phone or in meetings for at least 5 or 6 hours in any given day, email allows me to be significantly more productive (and to process more information and communication with a far greater number of people) than without it.

So it’s with much curiosity that I’m watching my friend Mark Solon – a partner at Highway 12 Ventures in Idaho – experiment with an email free summer. He describes the heart of his thesis this way: If the people who sent the majority of those e-mails knew that I didn’t have an inbox, they would have either picked up the phone and called me or (and this is the heart of it) probably wouldn’t have bothered because it really wasn’t that important after all. The link above will take you to the article he wrote about the project. I like Mark, but I’m skeptical that this is going to work. Even with his secretary printing out important documents (board packages and the like), the limits of old school communication in my mind significantly outweigh the upside from people self filtering their communications with you. Not to mention, I’d be perpetually worried that I was missing something.

We’ll see what Mark has to say at the end of the summer. I’m curious in the meantime – could you live without email?

One Metric to Rule Them All

A well instrumented business will have literally hundreds of metrics that they track to understand the key parts of their business. Each group within an organization likely has a key metrics dashboard that guides their department functioning and informs their decision making. These dashboards then roll up to other dashboards to form the core of the key metrics that an executive team or CEO look at daily (or more) to keep their pulse on the functioning of their operations.

A well instrumented business will have literally hundreds of metrics that they track to understand the key parts of their business. Each group within an organization likely has a key metrics dashboard that guides their department functioning and informs their decision making. These dashboards then roll up to other dashboards to form the core of the key metrics that an executive team or CEO look at daily (or more) to keep their pulse on the functioning of their operations.

But what if you didn’t have the luxury of having all these data sources at your fingertips? What if you were forced to decide on one number that was THE number. A single metric with which to keep your pulse on the health of your business.

I’ve asked this question to many CEOs and what’s surprising is how difficult it is to come up with the right answer. But also how illuminating it is once you do. It’s almost universal that your first response isn’t really the right answer upon further reflection. I’d encourage you to try this exercise yourself. You’ll likely focus in on something that is driving your business right now – something you’re keenly focused on and that gives you some kind of insight into future performance. Maybe a sales funnel number. Possibly cash burn. But think more deeply about it. At the core of what you do as a company, underneath the veneer of the business itself is typically an underlying data point that is at the heart of the product or service that you’re providing. That may be the number of domains that you manage, the number of emails that you send out daily, the number of unique website visitors that your business generates. Rarely is this number an input, nor is it generally a forward looking statistic. It’s also likely not a financial number – you won’t find this metric on your income statement. It’s generally an operationally derived output to the running of your business. Surprisingly (and this is part of the power of this exercise) in many cases it’s not something that you’re already tracking on your highest level dashboard. This last point shows the real value of thinking through the “one metric” question thoroughly. I’ve been amazed at how often the answer to the question of what metric would your business track if you were only able to track one thing is something that companies aren’t necessarily watching that closely.

While it may be tempting to just throw out the first thing that comes to your mind as you read the preamble to this chapter and then be done, that’s not the way to do this exercise. And like many things, the journey to the answer is half of the reason to ask the question in the first place. This is a brainstorming exercise that requires some thought and attention. And preferably the help of your management team and even some outside advisors who aren’t as close to the day to day business and can offer you the feedback that only that outside perspective can provide. As you come up with your list and pare it down you might even try focusing on just one of those metrics each day. Force yourself to live the exercise (at least at the CEO or department manager level) and really test out whether you feel that what you’re measuring is really getting to the heart of your company.

Why do this exercise?

Confining yourself to a single metric – even if it’s just for the purpose of a simple exercise – is a chance to remember what it is that your business does at its core. What’s the lowest common denominator of the service that you provide and how can you measure that? What were some of the other numbers you considered and why? Ideally this is an exercise conducted with your entire executive team. And like a Rorschach, the process of choosing a single metric to measure your business by can help you gain insight into the types of managers you have around your executive table and what their biases are. A good CEO can use this information effectively to better manage not just their business but also their executive team.

Should you run your business on a single metric?

Now that you’ve boiled down your company to a single, measurable metric it’s natural to consider whether you can shed all of the other clutter on your dashboard and simply focus on the one thing that really measures the heartbeat of your company. I have another post coming about how the best financial plans actually limit the number of operational inputs they consider in an effort to better focus the power of their model on the small number of things that actually matter (and to more easily run sensitivities on those inputs). Operational metrics can work the same way. And while I wouldn’t argue that you should pare your dashboard down to one large blinking number that is your “one metric”, consider using this exercise as a way to remind yourself what really matters in your business and focus on those things that most effect that number.

The power of simplicity

There’s a great story that Atlassian tells about how they leveraged the power of a single metric into meaningful data that changed the way they ran their business. In this case they were measuring employee happiness (we’re departing here from the “one metric” concept above, but the story illuminates how a single, relatively simple metric can be quite powerful). Outside of conference rooms, bathrooms and the break room this company placed a bunch of iPads on which it asked a single simple question: “Are you happy today?” There was no sign-in. No tracking of who said what. No 1-10 scales. Just a single question with a binary answer. And it was amazing how powerful this exercise was to the operations of their business. Participation was high (it was easy and anonymous to take part) and the company found that it was much more predictive and a better guide to behavior than the longer survey they sent around once a year. The point of this story isn’t that employee happiness is likely your “one metric” (it isn’t), nor even that you should consider doing this same thing in your company (you should; it is easy and cheap and very effective) but rather that sometimes the simplest of metrics has the power to meaningfully inform your understanding of your business.

Trends in M&A Deal Terms

For the past several years Shareholder Representative Services (SRS) has been publishing aggregate data on trends in M&A. These aren’t just high level observations, but rather are nitty gritty, details around the some of the most important terms contained in purchase agreements. As a self proclaimed M&A geek, I live for this stuff. And if information is power, this study dishes out plenty. And as a result helps level the playing field for companies (who transact very infrequently), their investors (who transact a bit more often) and buyers (who often have dedicated M&A practices who do nothing but execute transactions).

I’ve been fortunate to be involved in a number of Foundry related transactions in the past year. Knowing market trends (and in some cases – and here’s where your VC may really be able to help you – knowing details of a specific buyer’s historic willingness to negotiate around certain terms) is extraordinarily valuable.

You’ll find the full SRS report here. There’s a brief statement about their methodology at the beginning that’s worth taking a quick perusal through before you dig in (the data are based on the 196 transactions on which SRS acted as representative).

A couple of trends that stood out to me:

– 86% of all transactions were all cash. With a favorable borrowing environment and many companies holding on to large cash reserves an increasing number of deals are all cash.

– 24% of transactions contained an earn-out. I’m generally not a fan of earn-outs and the continued relatively frequent use of them is a little surprising to me (this figure was 25% last year).

– Average Escrow period was 15 months. The detail here is pretty interesting. The most common escrow period was 18 months (44% of deals), and 12 months was the 2nd most common period (24% of deals).

– Escrow size averaged just under 13%. This is always a hotly debated issue in transactions. Interestingly the median escrow size was over a point lower at 11.7%. There’s a chart below showing the distribution of escrow size.

One item that wasn’t covered in the study but which I think would be interesting is to see the % of transactions where there is a buyer initiated management incentive plan of size (say above 10% of the total consideration). We’re seeing more and more buyers use this tactic to either incent management (nice view) or separate management from their investors (the not nice view). Either way, they can be significant and I’d love to see how common they are and what percentage of deal proceeds are set aside for this purpose.

One item that wasn’t covered in the study but which I think would be interesting is to see the % of transactions where there is a buyer initiated management incentive plan of size (say above 10% of the total consideration). We’re seeing more and more buyers use this tactic to either incent management (nice view) or separate management from their investors (the not nice view). Either way, they can be significant and I’d love to see how common they are and what percentage of deal proceeds are set aside for this purpose.

Sltashdotted for VCs

I got the VC equivalent of Slashdotted today when Daniel Primack of PE Week Wire referenced my “How to become a venture capitalist” post in his daily e-mail this morning. Traffic on my blog went crazy (it was already running

a little high this week from that post – particularly after Brad and Fred each referenced it at my request). I’ve even had some publications ask me if they could reprint the article. Pretty cool stuff.

As a result there are a lot of people hitting my site that are first time readers. Allow me to suggest a few posts to check out that I think are representative of my writing.

Here’s why I blog (link)

Here’s why I call this blog VC Adventure (link)

Here are some posts specific to Venture Capital (link)

Here are three posts that I really like a lot:

The Ten Minute Difference

Conveying Information Effectively

If you like these, I hope you’ll consider subscribing (see the links to the right, including a way to subscribe through a service that will deliver my posts (and any others you like) directly to your inbox. And thanks for reading.